The first few months of 2024 have come as somewhat of a surprise to investors. For example, US growth has stayed resilient, continuing to defy the odds of recession, so markets have had to reevaluate their expectations for the year. And we are no different. Investing is about finding the right balance between having conviction in your long-term strategy and being conscious of the opportunities in the short term.

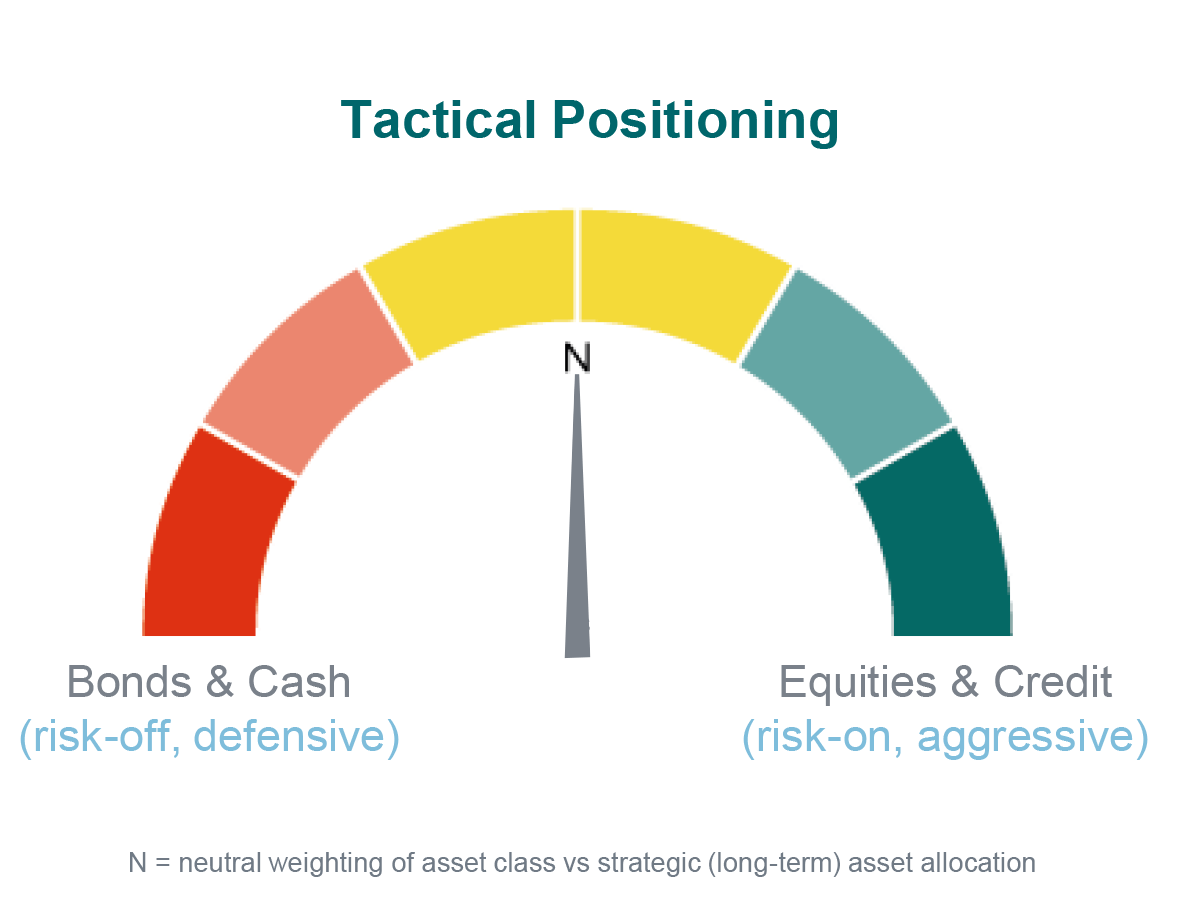

We manage this balance through a strategic asset allocation (‘the long term’) and a tactical asset allocation (‘the short term’). So, when you hear a wealth manager say they’ve brought a particular asset class ‘back to neutral’, it simply means that their tactical asset allocation aligns with their strategic asset allocation – at least for that asset class. I mention this because, based on the data we’ve seen, that is precisely what I and the Investment Committee have been doing in some asset classes this year.

Reallocating from defensive European equities to the US

At the start of 2024, we brought our equity and bond allocations back to neutral, having previously owned a slightly lower proportion of equities and more bonds. However, there are still differences between our tactical and strategic asset allocations when it comes to sectors and regions. For example, we previously owned fewer US equities compared to our strategic asset allocation. But, due to the resilience of the US economy, we’re bringing that back to neutral, while keeping a lower Eurozone equity allocation.

We’re funding this increase in US equities by selling part of our European equities, specifically minimum-volatility European equities. In Europe, growth has been at or near zero for some time, but it’s not getting worse and appears to have bottomed out. Therefore, we think it’s unlikely that European minimum-volatility sectors (which do comparatively well when the economy is worsening) will outperform the broader European market.

An active portfolio management approach to US equities

You may already be aware that we recently launched the first in a range of multi-manager funds, known as our QMM Fund Range, which our parent company, Quintet, has co-created with BlackRock. The first fund to launch is the QMM Actively Managed US Equity Fund. It’s available exclusively to all Quintet Group clients, from those who invest in our flagship portfolios to those in customised and advisory portfolios. This fund – as well as the others in the range – is made up of an optimised blend of leading third-party managers that aims to outperform its benchmark by combining different styles of actively managed strategies.

The investment I mentioned above into US equities, funded by the sale of the European minimum-volatility position, has been implemented through the QMM Actively Managed US Equity Fund. As we launch future QMM Funds, we will communicate how we are implementing them in the flagship portfolios, as I’ve done here.

An investment instrument to partially mitigate risks of a market fall

To repeat what I said at the start of this note: investing is a balancing act. While the growth data out of the US are better, this resilience is leading to stickier inflation than expected, which in turn may lead to fewer interest rate cuts from the US Federal Reserve. While we now reflected a new, shallower rate-cutting cycle in our base case, we’ve been thinking for some time that equity market expectations are perhaps somewhat optimistic. Think about it: valuations for the US are on the demanding side, analyst earnings expectations keep rising, and there are plenty of policy and (geo)political events, including the all-important US election in November.

To be clear, we’re not forecasting an imminent, significant equity market correction in our base case. Rather, given the above, we’ve bought ‘insurance’ to partially protect our flagship portfolios and those where client knowledge and experience, and regulations, permit, in case of unforeseen negative events in the short term. This insurance is an investment instrument that would increase in value if there was a substantial equity market sell-off within a defined range below the purchase level. It would offset part of the losses in such a hypothetical scenario. Similarly, if equities increase, the value of the instrument will fall. However, given the relatively low cost of the instrument, the loss is similar to buying car insurance and your car not breaking down. You buy it hoping you don’t need it, but it gives you peace of mind.

Geopolitical risks and Middle East tensions in the context of our strategy

A central theme of our 2024 outlook is a ‘fragmented world’ along more marked geopolitical lines. The thesis is that geopolitical actors with contrasting objectives can spur market volatility. Take what’s happening in the Middle East, where tensions appear to have resurfaced, as an example about how to think about geopolitical risk. Who would have thought that the week would have started with markets responding positively: oil prices fell, equities rallied, bond prices declined. That’s likely a response to the news of no further escalation, perhaps teaching a lesson to the investors who overreact.

At the same time, one doesn’t want to be complacent either, and we’ve subsequently seen markets giving back these gains on news of a possible escalation further down the line and selling off. All this suggests that market volatility may be rising. One of the most sensible strategies to mitigate the risks of local events is to invest in a globally diversified portfolio. We can also take more specific actions in the face of geopolitical uncertainty. Ours was to buy assets, such as commodities, that can support portfolios in this environment, plus the ‘insurance’ instrument mentioned above.

If you want to discuss your portfolio positioning or learn more about the QMM Fund Range, your Client Advisor will be happy to help.

Important Information

Information correct as of 18 April 2024.

This document is designed as marketing material. This document has been composed by Brown Shipley & Co Ltd ("Brown Shipley”). Brown Shipley is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales No. 398426. Registered Office: 2 Moorgate, London, EC2R 6AG.

This document is for information purposes only, does not constitute individual (investment or tax) advice and investment decisions must not be based merely on this document. Whenever this document mentions a product, service or advice, it should be considered only as an indication or summary and cannot be seen as complete or fully accurate. All (investment or tax) decisions based on this information are for your own expense and for your own risk. You should (have) assess(ed) whether the product or service is suitable for your situation. Brown Shipley and its employees cannot be held liable for any loss or damage arising out of the use of (any part of) this document.

The contents of this document are based on publicly available information and/or sources which we deem trustworthy. Although reasonable care has been employed to publish data and information as truthfully and correctly as possible, we cannot accept any liability for the contents of this document, as far as it is based on those sources.

Investing involves risks and the value of investments may go up or down. Past performance is no indication of future performance. Currency fluctuations may influence your returns.

The information included is subject to change and Brown Shipley has no obligation after the date of publication of the text to update or amend the information accordingly. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it.

This is non-independent research and it has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

All copyrights and trademarks regarding this document are held by Brown Shipley, unless expressly stated otherwise. You are not allowed to copy, duplicate in any form or redistribute or use in any way the contents of this document, completely or partially, without the prior explicit and written approval of Brown Shipley. Notwithstanding anything herein to the contrary, and except as required to enable compliance with applicable securities law. See the privacy notice on our website for how your personal data is used (https://brownshipley.com/en-gb/privacy-and-cookie-policy).

© Brown Shipley 2024