What are examples of alternative investment strategies?

We invest in a range of strategies within our portfolios to help navigate volatile markets and take advantage of investment opportunities as they arise. Below is a selection of the most popular strategies liquid alternative fund managers use, although this is not an exhaustive list.

Long/short investing: To understand long/short investing, it is important to understand the difference between long and short positions. Long positions are what most of us associate with investing. One invests in an asset you believe will increase in value over time. Short positions, however, are investments that profit from falling asset prices. While a regular long-only fund only benefits when markets go up, a long/short strategy benefits as markets fall (from the fund’s short positions) and markets rise (from the fund’s long positions). This means that a fund manager can manage market volatility better.

Event Driven: These strategies look for catalysts, such as mergers or acquisitions and other corporate events, which can cause a mispricing of an asset, which they can profit from. These are often employed by hedge funds and other institutional investors looking to generate returns by taking advantage of a fall in a company’s share price following a corporate event or market development.

Global Macro: Funds using a Global Macro strategy invest based on global macroeconomic trends and geopolitical events. They invest in in various asset classes, including stocks, bonds, currencies, commodities, and derivatives based on what they think will happen in the macroeconomy. For example, they might consider how changes in interest rates of a particular country will affect its bond market, then invest according to how they predict the market will move. Successful global macro fund managers are often those who can accurately anticipate and position their portfolios to profit from significant market moves.

What are the benefits of liquid alternatives?

Liquid alternatives can offer several benefits to a traditional multi-asset portfolio:

Diversification: Traditional portfolios invest in equities and bonds, which can suffer during periods of market uncertainty. Liquid alternatives tend to have a low correlation with these traditional asset classes, so they can move independently of the stock and bond markets. This provides a layer of diversification to an investor’s portfolio as the well-performing assets balance out the low-performing assets.

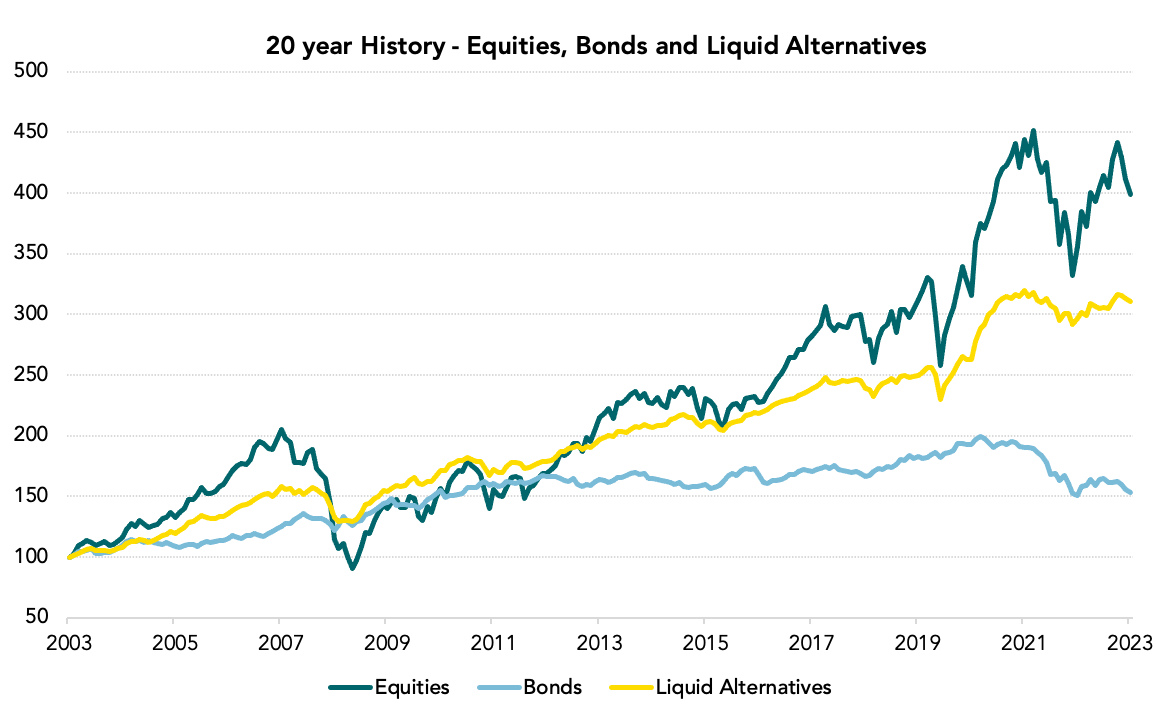

Competitive risk-adjusted returns: While past performance is not a reliable indicator of future returns, liquid alternatives can offer a similar return to global equities but with lower volatility as shown in the chart below.

Source: Bloomberg; data indexed to 100 on 31st October 2003; past performance is not a reliable indicator of future returns.

Source: Bloomberg; data indexed to 100 on 31st October 2003; past performance is not a reliable indicator of future returns.

Focus on downside protection: Sharp drops in an investment’s value increases the volatility of a portfolio, which can reduce the compounding effect of returns. Liquid alternatives focus on protecting against significant losses, thereby reducing the volatility of an investor’s portfolio, meaning they can benefit from long-term compounding returns.

Flexible investment strategy: Liquid alternatives usually have a flexible and active investment strategy, which is often based on the highly specialised expertise of the fund manager. This flexibility allows the manager to move rapidly to profit from market opportunities when they arise.

What are the risks of liquid alternatives?

While liquid alternatives offer advantages, they also come with their own set of risks, including:

Manager Risk: The success of a fund often depends on the skill and expertise of the fund manager. If the manager makes poor investment decisions or leaves the fund, it can negatively impact performance. This is a similar risk in traditional funds, but the wider strategy set employed by liquid alternatives amplifies this risk.

Higher fees and performance fees: Liquid alternative funds typically charge higher fees than traditional investment vehicles, which can erode returns. They also often charge performance fees, meaning the fund manager takes a percentage of the profits. While this aligns the manager’s interests with those of the investors, it can incentivise the manager to take excessive risks to boost returns.

Leverage: Liquid alternative funds can use borrowed funds (known as leverage) to amplify returns. While leverage can enhance profits, it also increases the potential for significant losses as it magnifies the impact of market movements.

Potential lack of transparency: Liquid alternatives are not always held to the same regulatory standards as traditional mutual funds. This means fund managers may not always disclose detailed information about the fund's holdings and strategies, making it harder for investors to assess risk.

Operational and risk management integrity: Such risks relate to operational aspects of running a hedge fund, such as inadequate risk management systems and internal policies.

While you can’t entirely eliminate these risks, in-depth due diligence, strict investment guidelines, thoughtful portfolio construction, and a systematic portfolio monitoring process can help to reduce them.

How to incorporate liquid alternatives in portfolios

Liquid alternatives can play a valuable role in portfolios due to the benefits listed above. However, it is important to consider the risks and whether are appropriate for your investment objectives.

Our team of experts can guide you through the strategies and details of our diversified portfolio. This portfolio can either function as a stand-alone investment or as part of your broader asset allocation. The percentage we recommend you allocate to liquid alternatives would depend on the chosen risk profile and your personal circumstances.

Should you like to know more or receive personalised advice tailored to your specific needs, please reach out to your Client Advisor.

Important Information

Information correct as of 8 December 2023.

This document is designed as marketing material. This document has been composed by Brown Shipley & Co Ltd ("Brown Shipley”). Brown Shipley is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales No. 398426. Registered Office: 2 Moorgate, London, EC2R 6AG.

This document is for information purposes only, does not constitute individual (investment or tax) advice and investment decisions must not be based merely on this document. Whenever this document mentions a product, service or advice, it should be considered only as an indication or summary and cannot be seen as complete or fully accurate. All (investment or tax) decisions based on this information are for your own expense and for your own risk. You should (have) assess(ed) whether the product or service is suitable for your situation. Brown Shipley and its employees cannot be held liable for any loss or damage arising out of the use of (any part of) this document.

The contents of this document are based on publicly available information and/or sources which we deem trustworthy. Although reasonable care has been employed to publish data and information as truthfully and correctly as possible, we cannot accept any liability for the contents of this document, as far as it is based on those sources.

Investing involves risks and the value of investments may go up or down. Past performance is no indication of future performance. Currency fluctuations may influence your returns.

The information included is subject to change and Brown Shipley has no obligation after the date of publication of the text to update or amend the information accordingly. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it.

This is non-independent research and it has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

All copyrights and trademarks regarding this document are held by Brown Shipley, unless expressly stated otherwise. You are not allowed to copy, duplicate in any form or redistribute or use in any way the contents of this document, completely or partially, without the prior explicit and written approval of Brown Shipley. Notwithstanding anything herein to the contrary, and except as required to enable compliance with applicable securities law. See the privacy notice on our website for how your personal data is used (https://brownshipley.com/en-gb/privacy-and-cookie-policy).

© Brown Shipley 2024