Forecasting economic growth and inflation can be difficult. In particular, the persistence of last year’s price rises surprised many economists and the recent decline in inflation levels (while still high) has come sooner than some expected. The fall has largely been due to lower energy prices, which in Europe has been helped by a relatively mild winter. Meanwhile, while economic growth is slowing, we believe most regions should be able to avoid a deep or prolonged recession.

As I mentioned in our 2023 Outlook, this year is set to be one where bonds finally make a comeback and start providing diversification and returns in portfolios. Global fixed income markets have rebounded strongly from last year, spurred by a growing conviction that inflation has peaked on both sides of the Atlantic. The gains have been driven by a substantial rally in long-term government debt. With hopes that last year’s fixed income retreat is over, bonds are restoring their traditional reputation as a haven against economic uncertainty.

This shift is in stark contrast to the past decade when government bond yields were at record lows and some even turned negative. With low-risk assets offering such poor returns, the only way to find decent bonds yield in recent years was to turn to the riskier end of the fixed income market. However, following the recent rise in government bond yields, we no longer need to take that extra risk to earn a decent return.

Daniele Antonucci, Chief Economist & Macro Strategist

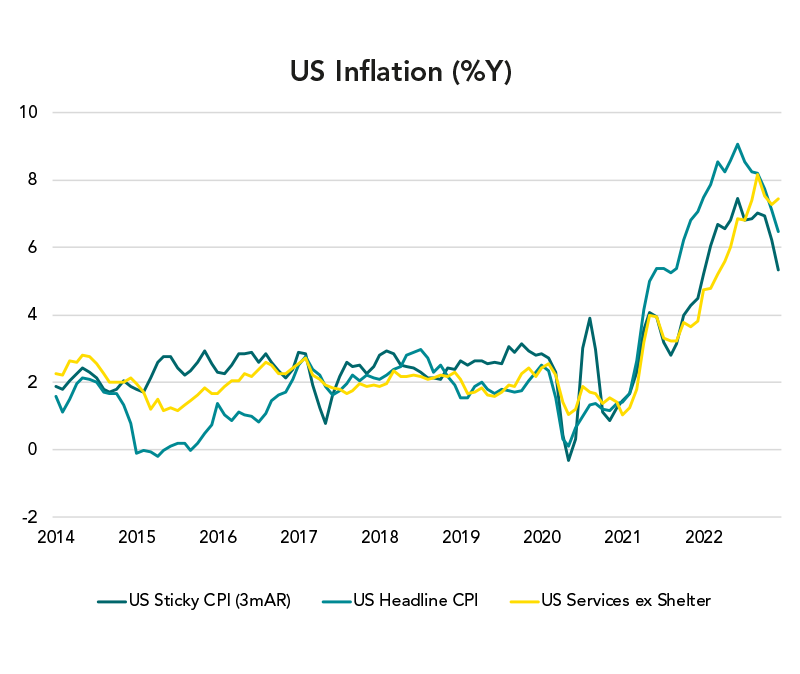

US inflation is showing encouraging signs of moderation.

The fall is largely driven by the unwinding of the pandemic-related factors, including lower demand for durable goods, and falling energy prices.

Services demand is still strong on the back of a solid labour market, while the shelter component should improve soon. Even ‘sticky’ inflation (i.e., for goods/services that adjust prices infrequently) is beginning to roll over.

Source: In-house research, Refinitiv

What’s happening?

Although the global economy continues to slow, several factors have contributed to a more optimistic outlook for the global economy at the start of 2023. They include a sustained fall in US inflation, signs that inflation is peaking in Europe, the faster-than-expected reopening of China’s economy and a warmer-than-normal European winter. But risks remain and global economies are not yet out of the woods.

Central banks have hiked interest rates aggressively to slow economic activity and bring down inflation, and their policies seem to be working. The key question is whether the drag from these tighter financial conditions will cause a recession. We believe a recession is still likely in the UK and euro area, although perhaps less extreme than feared. The US, driven by the Fed, may also experience one but potentially milder given there are fewer imbalances than previous recessions: for example, household and corporate balance sheets are stronger while banks are better capitalised relatively to past recessions.

Following a recessionary environment at the start of the year, we expect a new economic cycle to take hold some time in the second quarter. Global growth should recover moderately, driven by China’s post-Covid rebound, peaking interest rates, slower inflation and fewer supply-chain strains. However, the war in Ukraine and any impact on energy prices are still key risks.

What we’re watching

In anticipation of the global economy entering a new phase of growth over the next few months, we have increased our exposure to high-quality government bonds, which offer attractive yields. Within equities, we’re keeping our slightly underweight position but believe a well-diversified equity mix can provide exposure to any renewed economic growth across both developed and emerging regions and we’re monitoring markets to ensure portfolios are appropriately positioned.

We could increase our equity exposure if inflation, interest rates and bond yields fall more rapidly than expected, the Ukraine War ends, China reopens its economy even faster or company earnings prospects improve substantially.

Although some risks seem to have receded at the start of 2023, a number of events could also cause us to dial down risk further. They include a policy mistake by central bankers if they hike rates too far, as well as a possible inflation spike due to energy prices or higher wages. From a geopolitical perspective, any deterioration of the Ukraine War or the relationship between China and Taiwan could also be negative for markets.

Continuing with our theme that 2023 is the year that bonds are likely to make a comeback, we are looking to take advantage of the valuation resets in 2022. We have shifted our fixed income allocations away from higher-risk/lower-quality emerging market (EM) bonds – both local and corporate – towards safer developed market government debt.

After years of low expected returns from safe bonds, we now expect them to provide a more meaningful long-term return to portfolios. This allocation allows us to achieve an attractive yield without the need to take on more credit risk, which is something that has been difficult in the negative-yielding world before 2022.

We are maintaining all our current tactical positions. Despite a more optimistic mood in markets during the final three months of 2022 and into the start of this year, we believe we are not out of the woods yet. In particular, we are focusing on gaining exposure to higher-quality fixed income assets such as US Treasuries and EU/UK investment grade bonds. We still favour EM equities and hard currency sovereign bonds, which should benefit from China reopening.

MACRO

Faster move past inflation/

Fed/bond yields peak

↓

Increase equity/fixed income

GEOPOLITICS

Russia/Ukraine

negotiations/end of war

↓

Increase EU equities/high-yield bonds

MACRO

China reopening

without major problems

↓

Increase EM/China risk exposure

POLICY

Central banks overtighten

even if inflation slows

↓

Reduce risk in equities & bonds,

add gold

GEOPOLITICS

Russia/Ukraine war

gets worse

↓

Reduce European risk exposure,

add gold

GEOPOLITICS

China/Taiwan/US

escalation

↓

Reduce EM/Asia

risk exposure

MACRO

European gas crisis

deteriorates again

↓

Reduce EU & UK

equities/high-yield bonds

MACRO

Wage-price spiral

pushing inflation higher

↓

Reduce bond exposure,

diversify further

Non-Independent Research

The information contained in this article is defined as non-independent research because it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research, including any prohibition on dealing ahead of the dissemination of this information.

How to Use this Information

This article contains general information only and is not intended to constitute financial or other professional advice or a recommendation that any recipient of this information should make any particular investment decision. Always consult a suitably qualified financial advisor on any specific financial matter or problem that you have.

Except insofar as liability under any statute cannot be excluded, neither Brown Shipley nor any employee or associate of them accepts any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in this article or for any resulting loss or damage whether direct, indirect, consequential or otherwise suffered by the recipient of this article.

Investment Risk

Investing in stocks either directly or indirectly carries investment risk. The value of equity based investments may go down as well as up over time due to factors such as, market volatility, interest rates, and general economic conditions.

Information correct as at 6 February 2023.

Past performance is not a reliable indicator of future returns

© Brown Shipley 2023 reproduction strictly prohibited.