In our 2024 Investment Outlook, released in December 2023, I mentioned the importance of building an investment strategy with multiple time horizons in mind. And, over the past two months, things have changed for the medium-term growth outlook. In January, the 2023 US growth figures came in better than expected, showing a resilience in the US economy that the market didn’t anticipate.

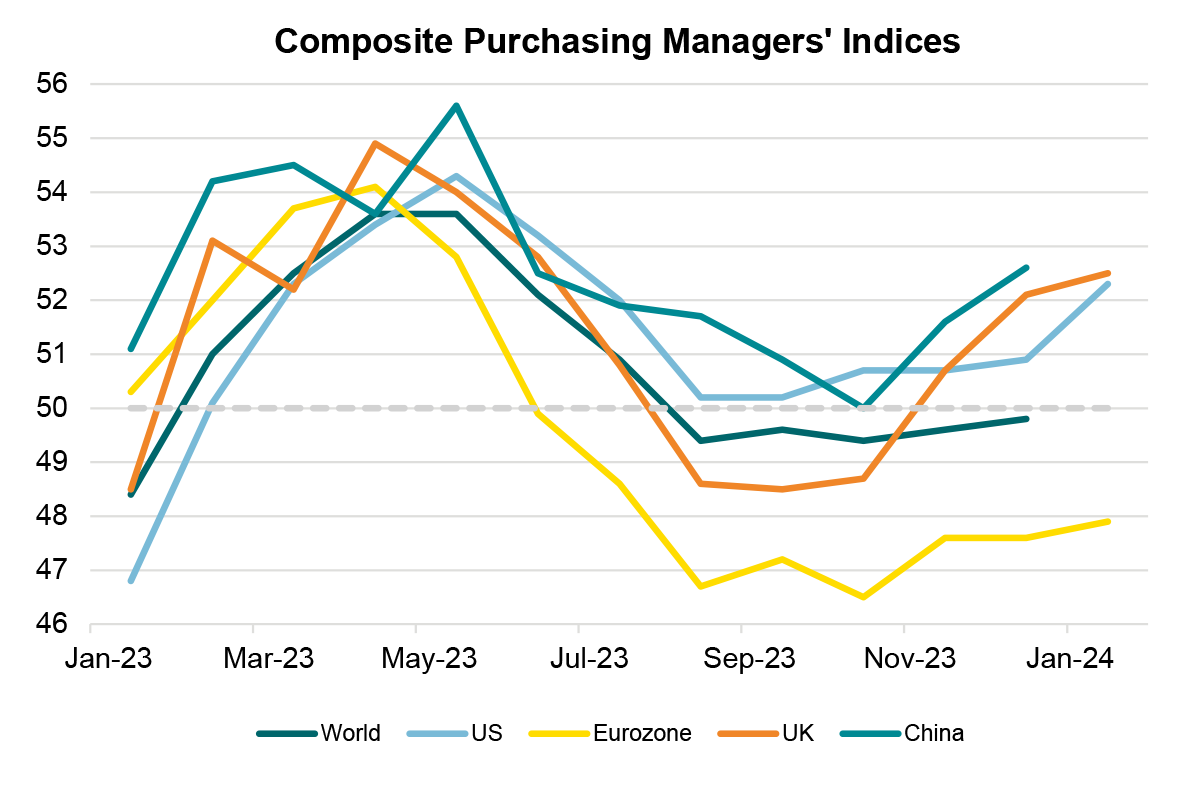

What’s more, the forward-looking economic indicators, such as the purchasing managers’ indices, are turning up too. This suggests that the US is now less likely to fall into a recession, certainly a deep one. Because of this, I and the Investment Committee have decided to continue to moderate our defensive portfolio positioning, a process we started in December.

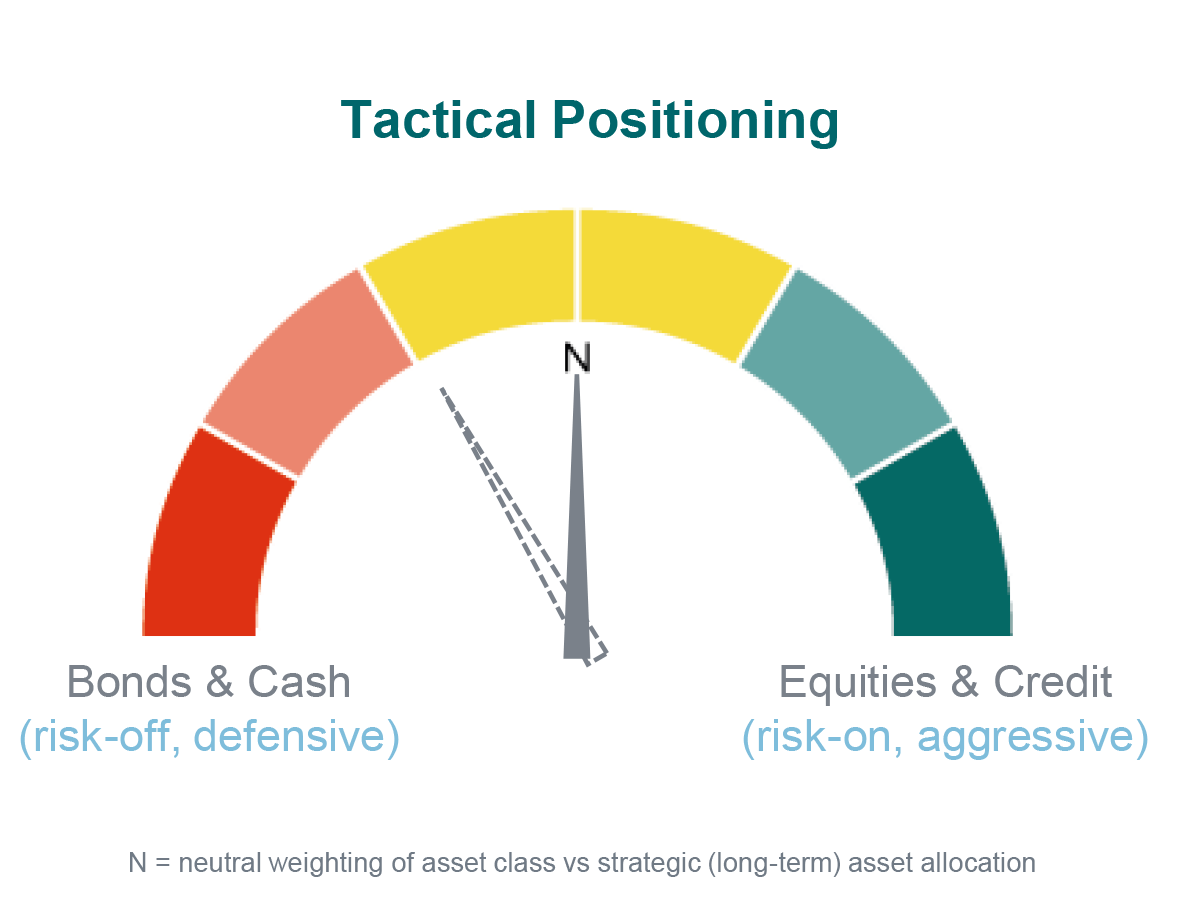

For about a year and a half, we’ve held fewer equities and more bonds in portfolios compared to our long-term strategy. Now, we are bringing both back to neutral. This means buying more equities and selling some bonds.

In the short term, elections, geopolitical tensions, global debt levels and market valuations are among the top topics on the Investment Committee’s mind. So, we’re not ready to dive head-first into the equity pond; we’ve been selective in our equity additions. We’ve opted for global small caps (smaller companies that tend to benefit when economic and earnings growth improves and surprises positively relative to expectations). These are attractively valued and are now less likely to face pressure from rising interest rates. We’ve also bought more broad US equities due to the improved growth outlook and the prospect of rate cuts on the horizon, and sold low-volatility stocks.

Unlike the US, growth in the Eurozone has continued to stagnate; it’s not deteriorating, though visible signs of a recovery haven’t appeared just yet. The economy keeps alternating between stagnation and mild contraction. Therefore, we still hold fewer Eurozone equities than normal. Those we have are mostly in defensive sectors, such as health care, consumer staples and utilities, which are less impacted by the slowdown in growth.

As I mentioned above, we needed to sell some of our bond holdings to fund our increased equity position. Given the substantial rise in bond prices at the end of 2023, we’ve decided to capture some gains by modestly reducing our US bond holdings. Similarly, we’ve reduced our UK government bond allocation in favour of the high-quality European Investment Grade (IG) bond market.

Given the prospect of rate cuts and the fact that bond prices rise as rates (and yields) fall, one could argue that government bonds are an attractive, low-risk investment – as we did in our 2024 Investment Outlook. So why reduce government bonds now? This was a hot topic in our Investment Committee meetings across the month, and we agreed the outlook for government bonds may be too optimistic. Specifically, we think the government bond market expects too many rate cuts from central banks and for them to come too soon. Therefore, the higher yield offered by European IG bonds compared with UK government bonds is attractive, particularly given the compelling valuations compared to their own history. As before, we maintain a reduced exposure to riskier bonds.

Tactical positioning | Getting to balanced

We now think the US economy has better prospects and a lower recession probability, given solid data most recently and an improvement in the main leading indicators. As such, we are slightly increasing our allocation to equities and reducing our allocation to bonds. Relative to our long-term, strategic asset allocation, we’re now neutral for equities vs bonds. In certain riskier markets where recession probabilities are higher, such as the Eurozone, we maintain a reduced exposure and prefer defensive equity sectors.

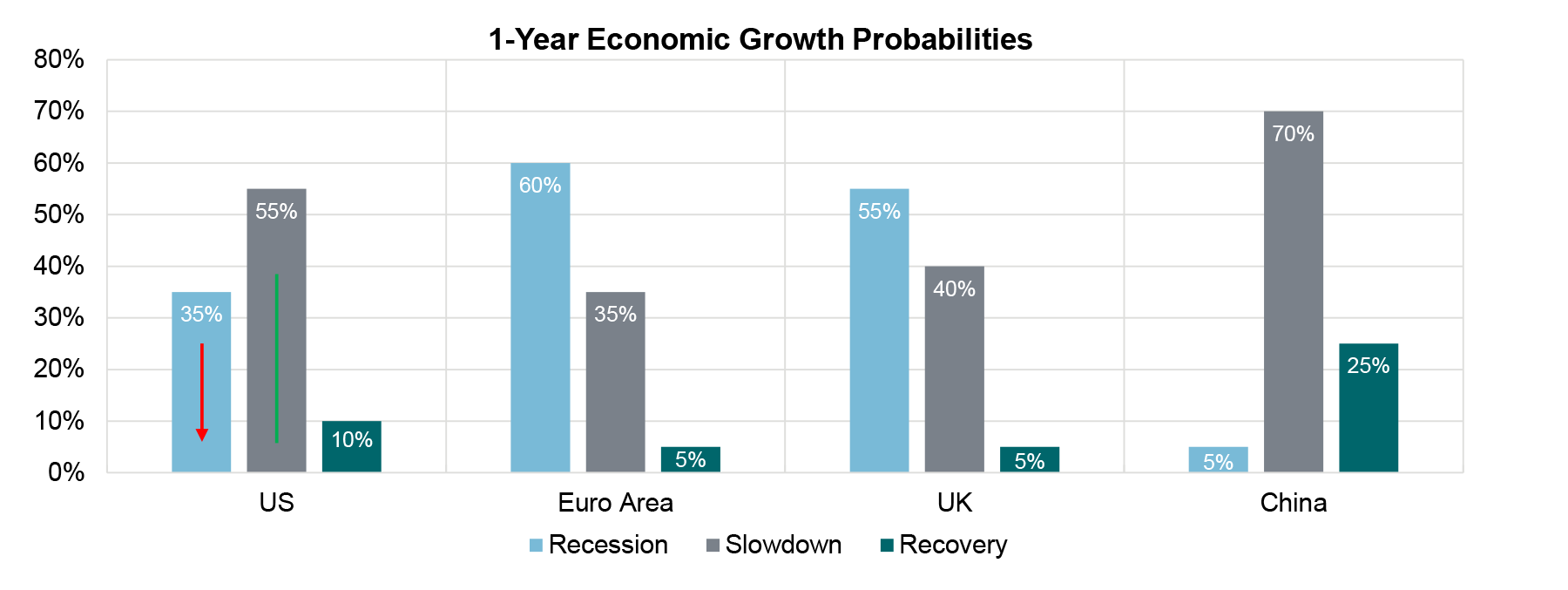

US | Lower probability of recession

The US economy has continued to defy expectations with robust growth despite elevated inflation. US GDP grew at an annualised rate of 3.3% in the final quarter of 2023, more than we and the market expected. This strong growth means that a recession in the near term, while still a possibility, is unlikely.

A deep recession seems quite improbable, especially as timely data including key business surveys are improving as well. We still believe a slowdown is the most likely scenario in the US but, given 2023’s growth rate, it will slow from higher grounds.

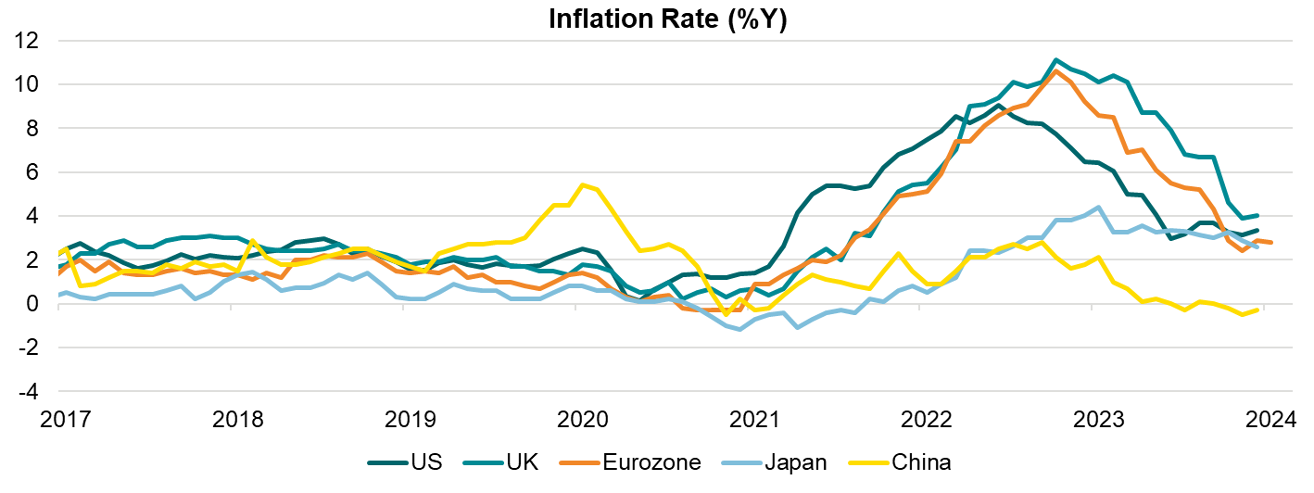

Despite an uptick in December’s inflation reading, US Treasury Secretary Janet Yellen announced in January that “inflation is under control”, boosting hopes that rate cuts are imminent. However, the US Federal Reserve (Fed) has pushed back on the prospect of cuts in the coming months, and we believe it won’t cut rates until close to mid-year.

When the Fed does start cutting rates, and therefore no longer outpaces other central banks, some dollar weakness is on the cards, albeit moderately.

Source: In-house research

Eurozone | Zero growth

The Eurozone economy has stagnated for over a year, with little or no growth in the region, occasional contractions as shown by the purchasing managers’ indices, and sluggish consumer confidence. So, while the outlook doesn’t seem to be getting much worse, it’s not improving either. We’re still forecasting that the most likely scenario for the Eurozone is a mild recession. But, as inflation continues to fall, the European Central Bank (ECB) should start cutting rates by mid-year to help stimulate the economy. As such, we expect a continued slowdown throughout the first half of 2024 before beginning to recover in the second.

Source: In-house research, Refinitiv; >50 = expansion; <50 = recession

UK | Playing catch-up on inflation

Like the Eurozone, the UK economy only grew modestly in 2023, as high interest rates and sticky inflation took a toll. The latest inflation reading came in around 4%, well below the highs of 2022 but still higher than the US and Eurozone. This prompted the Bank of England (BoE) to keep rates unchanged since the last rise in August. Despite a stagnating economy and still elevated (but declining) inflation, consumer confidence reached a two-year high in January, suggesting that fears of prolonged price pressures and high interest rates may be dissipating. However, we forecast that a mild recession is still possible before a recovery in the second half of the year as the Bank of England begins cutting rates.

Source: In-house research, Refinitiv

China | More stimulus likely

Despite exceeding the government’s 5% growth target in 2023, China’s post-covid recovery has been anything but smooth. The ongoing real estate crisis still weighs on the economy, and China is now experiencing mild deflation. The People’s Bank of China has announced some stimulus measures, but we’re yet to see the impact. The stimulus could be a short-term tailwind for the weakening equity market and the crisis in the property sector. However, we don’t believe it’s likely to be a long-term game changer for the struggling economy. We believe China will likely need further stimulus measures as domestic and export demand are both sluggish.

Source: In-house research, Refinitiv

Japan | All eyes on the BoJ

Despite moderate growth, falling inflation, and a strong equity market, investors’ eyes are on when Japan’s central bank will exit its current negative interest policy. In its latest meeting, the Bank of Japan (BoJ) hinted that it could look to raise interest rates in positive territory in a few months. This could mean the BoJ raises interest rates while the Fed cuts them, potentially creating challenges as it would strengthen the currently weak yen. Given the substantial earnings Japanese companies make from overseas investment, the weakness in the yen relative to the dollar or euro has helped company performance. If the currency outlook changes, we expect a few speedbumps in the road for Japanese earnings.

Equities | Shifting back to neutral

We believe equities now have a more balanced risk-reward over 12 months, given our expectation of interest rate cuts and a lower probability of recession in the US. As such, we’ve increased our equity position to neutral relative to our strategic asset allocation, with increased positions in global small caps and broad US equities. This means we’ve closed our position in low-volatility US stocks, which have rebounded on a relative basis over the last six months and are now less likely to outperform the broader US market.

Given the higher recession probability in the Eurozone, we’re keeping our underweight position in Eurozone equities. For the most part, the equities we own in the region are in defensive, low-volatility sectors such as health care, consumer staples and utilities.

Government Bonds | Back to neutral

Our overall risk stance moves more neutral as we increase our allocation to equities and reduce our allocation to bonds. More specifically, to increase our exposure to European investment grade credit, as valuations are compelling, we reduce our exposure to US investment grade credit (for EUR portfolios)/US bonds (for GBP portfolios) and European/UK government bonds. In general, we think government bond markets expect too many interest rate cuts and so there could be a near-term vulnerability.

To be clear, though, some amount of government bonds still makes sense to us, both for diversification purposes and to build a portfolio that could be more resilient should the economic outlook disappoint market expectations.

Corporate Bonds | Increasing high-quality credit

We’re increasing our exposure to the high-quality European Investment Grade (IG) bond market. European IG bonds look more attractive as bank lending standards have eased somewhat and ECB rates have peaked. We’ve funded this partly through our reduction in US bonds. In terms of valuation, European IG bonds look attractive to us, especially considering that our base case is a mild economic contraction followed by recover. We think riskier bonds, conversely, don’t offer enough compensation for the risk of a worse-than-expected outlook, and so we maintain our reduced exposure to riskier, high-yield bonds.

Commodities | A cushion against geopolitical uncertainty

Geopolitical tensions continue to dominate the news, but we believe the impact is unlikely to be long-lasting on energy markets as the supply/demand picture reveals a rather balanced outlook for oil. Plus, energy, metals and other hard commodities should be supported in a scenario where shipping, transport and supply disruption could materialise and drive costs higher.

Therefore, we are keeping our broad commodities exposure, which can help protect portfolios from any short-term uncertainty in geopolitics and energy prices. Given the recent all-time highs in gold prices, our fair value model shows that the precious metal is currently overvalued. We still see a place for gold in our cautious portfolios, but prefer to diversify through broader commodities in our higher-risk profiles.

Thematic Investments | Trends beyond market cycles

Our investment horizon for thematic investments is long-term and doesn’t typically change from month to month. Our preferred ones for our bespoke portfolios are those exposed to key trends that can help investors cut through any short-term market noise. In particular, productivity themes – such as robotics and automation, cloud computing and processing power – offer the most scope for value creation in the long term. But, among others, we also look at planet themes such as clean energy, electric vehicles and water & waste, and people themes such as the future of health and the aspiration economy (luxury goods & gadgets).

Alternatives | A broad opportunity set

We believe opportunities are available in private markets and could outperform public market equivalents over longer horizons, especially as the market environment now looks driven by more granular, specific factors. In our bespoke portfolios, we think there’s scope to benefit from possible revaluations in private equity over the coming year or so, and capital scarcity in private debt and infrastructure. In such cases, we focus on high-quality businesses that maintain stable margins and have lower leverage than average. While the sector still looks somewhat more heterogenous, some opportunities could emerge in real estate, too.

Important Information

Information correct as of 12 February 2024.

This document is designed as marketing material. This document has been composed by Brown Shipley & Co Ltd ("Brown Shipley”). Brown Shipley is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales No. 398426. Registered Office: 2 Moorgate, London, EC2R 6AG.

This document is for information purposes only, does not constitute individual (investment or tax) advice and investment decisions must not be based merely on this document. Whenever this document mentions a product, service or advice, it should be considered only as an indication or summary and cannot be seen as complete or fully accurate. All (investment or tax) decisions based on this information are for your own expense and for your own risk. You should (have) assess(ed) whether the product or service is suitable for your situation. Brown Shipley and its employees cannot be held liable for any loss or damage arising out of the use of (any part of) this document.

The contents of this document are based on publicly available information and/or sources which we deem trustworthy. Although reasonable care has been employed to publish data and information as truthfully and correctly as possible, we cannot accept any liability for the contents of this document, as far as it is based on those sources.

Investing involves risks and the value of investments may go up or down. Past performance is no indication of future performance. Currency fluctuations may influence your returns.

The information included is subject to change and Brown Shipley has no obligation after the date of publication of the text to update or amend the information accordingly. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it.

This is non-independent research and it has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

All copyrights and trademarks regarding this document are held by Brown Shipley, unless expressly stated otherwise. You are not allowed to copy, duplicate in any form or redistribute or use in any way the contents of this document, completely or partially, without the prior explicit and written approval of Brown Shipley. Notwithstanding anything herein to the contrary, and except as required to enable compliance with applicable securities law. See the privacy notice on our website for how your personal data is used (https://brownshipley.com/en-gb/privacy-and-cookie-policy).

© Brown Shipley 2024