What you need to know

- Active ownership influences company practices and behaviours with a view to preserving and enhancing long-term value.

- The main tools are engaging with company management to encourage change and voting at shareholder meetings. Research shows that active ownership is linked with improved company performance and reduced risks.

- We’re committed to active ownership. In 2021 we voted at 760 shareholder meetings and engaged with 752 companies. We hold one of the most progressive voting records in the investment industry by supporting more than 90% of environmental and social shareholder proposals.

Section 1: Active ownership in the financial industry

What is active ownership?

Active ownership is when investors influence company practices and behaviours to preserve and enhance the value of assets, which will ultimately benefit businesses, investors, people and the planet. The most popular tools are voting and engagement.

How does voting work?

Voting involves casting ballots at shareholder meetings, which provide opportunities for investors to express their opinions on how companies are managed. Typically, the issues raised by management for a shareholder vote relate to board structure, audit, executive pay and capital structure. Increasingly, shareholders are using their ability to propose resolutions to raise attention to sustainability issues and gain wider support.

How does engagement work?

Engagement involves having active dialogue with company senior management on environmental, social and governance (ESG) issues or business strategy topics in order to manage risks and improve performance. Investors can utilise various communication channels to engage, such as in-person meetings, conference calls, letters and emails.

Investors can engage individually or in collaboration with other investors. A collaborative approach can be particularly effective due to greater visibility, larger influence on company management and improved efficiency from sharing knowledge and resources. Collaborative engagement can be coordinated on behalf of investors by a specialist stewardship service provider or through industry initiatives and platforms such as the Principles for Responsible Investment (PRI).

What is the value of active ownership?

Both investors and companies benefit from active ownership. It is a learning opportunity where companies can improve their practices, which can potentially result in better operating performance. Active ownership can enhance the investment process by uncovering valuable information to guide decisions. Through engagement, investors can encourage positive change, while also benefiting people and the planet.

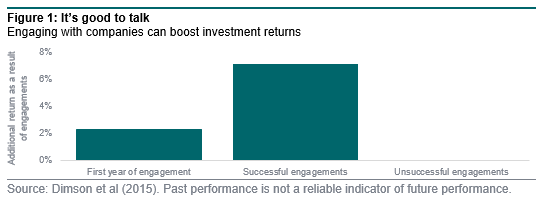

Academic evidence supports this theory. A review of US public companies from 1999 to 2009 suggests successful engagements can boost investment returns by more than 7.0% (figure 1).1

Another study reviewed 1,712 engagements across 573 firms between 2005 and 2018, and found they reduced downside risk as measured by value-at-risk (VaR).2

What are the challenges for active ownership?

The effectiveness of engagement can be undermined by communication and resource challenges. Language and cultural barriers, underdeveloped relationships and lack of appropriate contacts can pose major obstacles. Research has found that face-to-face meetings and maintaining a dialogue with the company chair or secretary are consistent with engagement successes.

3

Shareholder structure and the distribution of voting rights can be a barrier to raising the voice of investors and passing environmental and social resolutions. For example, at the last Facebook shareholder meeting, due to its dual share class structure, the CEO, Mark Zuckerberg controlled approximately almost 60% of the company's total voting power, making it impossible for a proposal to pass without his support.

What are the recent trends in active ownership?

Active ownership has become a powerful tool for investors to address sustainability concerns and influence corporate behaviour. Over the past year, investors have demonstrated unprecedented support for environmental and social resolutions brought by shareholders. The average support for US shareholder proposals increased to an all-time high of 34% in 2021 from 29% in 2019.

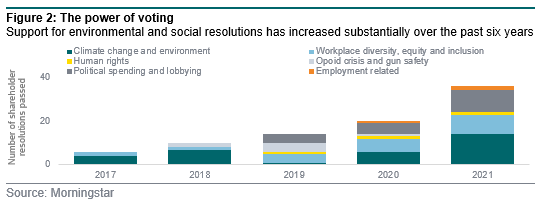

At US companies, a record of 36 shareholder resolutions passed with majority support in 2021, and over a third were about climate change and the environment (figure 2).4 Before 2021, only three climate-related shareholder proposals received majority support at US oil majors. That number has now more than tripled.

In the current 2022 voting season, the number of shareholder resolutions being filed has grown by an impressive 23% from 2021.5 This year’s ballots will likely see further requests on climate change, diversity and inclusion, employee health and safety, and executive pay.

Human rights and biodiversity stand out as growing areas of investor concern for engagement. In a survey of 60 institutional investors representing over USD 47 trillion in assets under management, 19% said they will prioritise engagements on human rights in 2022 compared with only 8% in 2021.6 Similarly, 17% of investors plan to prioritise biodiversity in their engagements, up from just 5% the year before.

Section 2: Quintet is committed to active ownership

How do we vote?

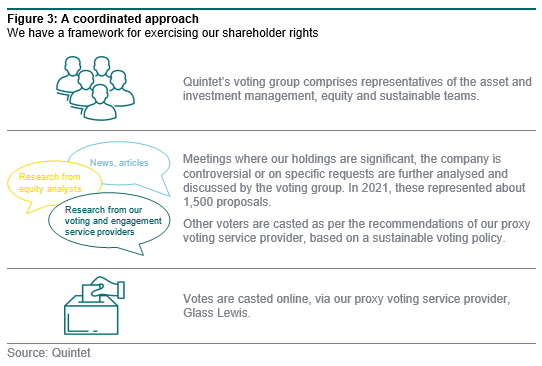

We coordinate our approach through a voting group7 composed of colleagues from our asset management, equity and sustainable investing teams. The diversity of background and centralised organization ensure expertise and decisions in line with our philosophy for all holdings, with the aim of being more impactful. The voting group meets weekly during the peak of the voting season and otherwise monthly to analyse shareholder meetings where our holdings are significant, the company is controversial or to discuss specific requests. In 2021 we analysed nearly 1,500 voting proposals for 91 meetings.

We cast other votes according to recommendations from our proxy voting provider Glass Lewis, based on a sustainable voting policy. We do not vote where additional costs or barriers are deemed prohibitive or where our holdings are limited (figure 3).

Voting covers individual equities held in our funds managed by our Luxembourg and Netherlands asset management companies, as well as our UK unitised funds.

What are the voting highlights from 2021?

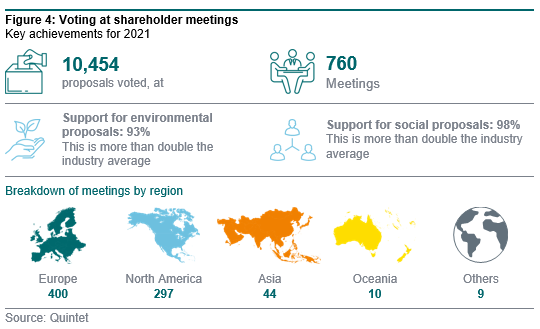

In 2021 we voted on over 10,454 proposals at more than 760 shareholder meetings across the world. We held one of the most progressive voting records in the investment industry by supporting over 90% of environmental and social shareholder proposals8, which is more than double the industry average.9

Key environmental proposals at the annual general meetings of the largest integrated oil companies (e.g. Shell and TotalEnergies) have been in the spotlight as more shareholders demand stronger commitments to address the threat of climate change. We supported those demands (figure 4).

How do we engage?

We collaborate with a leading stewardship service provider, EOS at Federated Hermes (EOS). On our behalf, EOS engages with companies whose shares and bonds we hold in our in-house managed funds, as well as advisory and discretionary mandates. To be effective in engaging with these companies, we believe a collaborative approach is likely to achieve better results than efforts we might undertake on our own.

Since we invest client assets with other asset managers, we also engage with them to communicate our beliefs and to understand theirs. We ensure the selected funds exercise voting and engagement with companies in which they invest.

Quintet is also a member of the Climate Action 100+ (CA 100+) initiative, a leading collaborative investor engagement on climate change and a signatory of the PRI, the world’s leading proponent of responsible investing.

What are the engagement highlights from 2021?

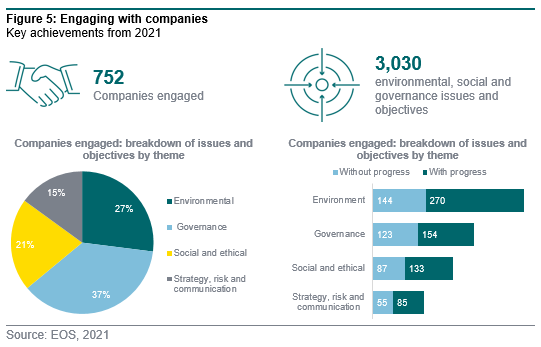

In 2021 EOS engaged with 752 companies on our behalf on a range of 3,030 issues and objectives. We assess these objectives regularly and in 2021 made solid progress in delivering our engagement objectives. For two-thirds of our engagements, at least one milestone was moved forward. Governance was the primary engagement theme, followed by environmental, social and ethical topics (figure 5).

Our fund selection team assessed over 50 third-party sustainable funds for portfolios and engaged with them to ensure their investment strategies and active ownership activities align with our beliefs. We successfully pressed for the creation of innovative sustainable products and encouraged the adoption of enhanced responsible practices.

Investor engagement through the CA 100+ initiative resulted in faster and more ambitious climate commitments. In 2021, 111 focus companies have set net zero targets for 2050 or before, compared with just five in 2018 when the initiative was launched. It is estimated that these net zero targets will reduce greenhouse gas emissions by 9.8 billion metric tons annually by 2050, roughly equivalent to China’s annual emissions.10

Where to find information on our commitment to active ownership?

We seek to be open and transparent about our active ownership efforts. We disclose the votes we cast over the past 12 months

here, our active ownership policy and reports are available on

our website.

1 Dimson, Elroy and Karakaş, Oğuzhan and Li, Xi, Active Ownership (August 7, 2015). Review of Financial Studies (RFS), Volume 28, Issue 12, pp. 3,225-3,268, 2015., Fox School of Business Research Paper No. 16-009.

2 Becht, M., Franks, J., Mayer, C. and Rossi, S. (2010). Returns to Shareholder Activism: Evidence from a Clinical Study of the Hermes UK Focus Fund. The Review of Financial Studies, 23(3), pp. 3093-3129.

3 Wolff, Jacobey and Coskun (2017). Talk is not cheap: The role of interpersonal communication as a success factor of engagements on ESG matters. University of Göttingen.

4 www.morningstar.com/articles/1052234/the-2021-proxy-voting-season-in-7-charts

5 Sustainable Investment Institute (Si2)

6 2022 Proxy season preview, EY Center for Board Matters. February 2022.

https://assets.ey.com/content/dam/ey-sites/ey-com/en_us/topics/board-matters/cbm-2022-proxy-season-preview-final-us-score-no-15036-221us.pdf?download

7 The members of the voting group are AJ Singh (Sustainable Investing Strategist), Amish Patel (Senior Equity Analyst & Strategy Lead), Arnoud De Beaufort (Head of Specialty Funds), Cyril Thiébaut (Head of Asset Management), Jean-François Jacquet (Chief Investment Officer) and Vitaline Copay (Sustainable Investing Strategist).

8 Statistics provided by Quintet’s voting service provider, Glass Lewis, based on proposals voted in 2021.

9 Glass Lewis reported in 2021 that average shareholder support for environmental and social proposals was respectively 42% and 31%.

10 Climate Action 100+, 2021 Year in Review Progress Update,

https://www.climateaction100.org/wp-content/uploads/2022/01/Climate-Action-100-2021-Progress-Update-Final.pdf

Important Information

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 14 March 2022, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2022. All rights reserved.

.png?width=650&resizemode=force)