This note contains an overview of our market views, what we are watching, and our portfolio strategy. These developments may not mean changes to your portfolio so please contact your Client Advisor for the latest update on your portfolio.

At a glance

- Last week, equity markets continued to make progress, posting better returns than bonds. This meant flagship portfolio performance was positive for the week.

- There was, however, some notable regional dispersion. UK equities were the standout performer last week, while emerging market equities continued to be dragged down by Chinese equities. Chinese growth disappointed in the second quarter, driven by slowing manufacturing and global growth, and ongoing trade tensions. On the positive side, this raises the probability of extra policy stimulus, which should be supportive for Asia-Pacific equities.

- In the US, while the S&P 500 closed the week in positive territory, the tech-focused Nasdaq fell following a strong run from tech stocks so far this year. This was perhaps due to earnings-related news flow (Netflix, Tesla to name a couple).

- Our choice to keep higher-than-normal exposure to high-quality government bonds proved beneficial, providing stability to portfolios as bond yields fell in Europe and the UK last week.

- Overall, markets continue to contend with mixed economic data. Last week, US jobless claims fell, retail sales were positive but missed expectations, and housing data contracted. The real miss came from falling purchasing manufacturing indices at the start of this week, with factory output estimated to fall at the fastest pace since the pandemic first took hold. Although the manufacturing sector has contracted globally for several months, the downturn in eurozone business and services activity was deeper than expected.

Past performance is not a reliable indicator of future returns.

How we’re positioned

- Given market headwinds and macroeconomic uncertainty, our flagship portfolios hold a higher-than-normal exposure to high-quality government bonds. In turn, we hold fewer equities and riskier bonds than normal.

- We have continued to benefit from our decisions to take profits in strongly performing equity segments and to hold more defensive positions. Specifically, our positions in low volatility equities in the US and Europe and in US dividend equities should provide support in times of market choppiness.

- Our focus on a balanced asset allocation proved effective in managing risks while capturing some of the upward trend in equity markets. Our tactical tilts may have dampened some of the upside, but they also acted as a mitigating factor when mega-caps faded, and non-tech and value stocks gained preference.

- Our holdings in Asia-Pacific equities including Japan remain promising, with the expectation of further stimulus and attractive valuations. Japanese equities, which delivered a solid performance tactically, offer potential for further gains.

What we’re watching

- The pause in the central banks’ tightening cycle is a moving target.

- Firstly, we believe a 25 bps increase in interest rates from the Fed is likely this week, to reach 5.5%. The central bank will probably signal another one will be needed, though whether this final hike will materialise remains a close call.

- Secondly, the European Central Bank will likely raise interest rates too, to take its main refinancing rate to 4.25%, and has long signalled it is ready to do more.

- Thirdly, we think the Bank of England (BoE) still has ground to cover to bring inflation down. Although inflation fell in June, wage growth is still strong, which supports the case for more rate increases. While there’s significant uncertainty on timing and magnitude of further rate increases, and there are arguments for slightly higher or lower peak rates, we now expect the Bank rate to peak at 6%.

- Lastly, the window for the Bank of Japan to raise rates remains narrow despite inflation still reading above the central bank’s 2% target.

- In terms of economic and corporate data, investors this week are likely to watch US GDP growth for the second quarter, which consensus estimates expect to show slower growth. Separately, big tech firms, such as Alphabet, Microsoft, and Meta, will report their second quarter earnings.

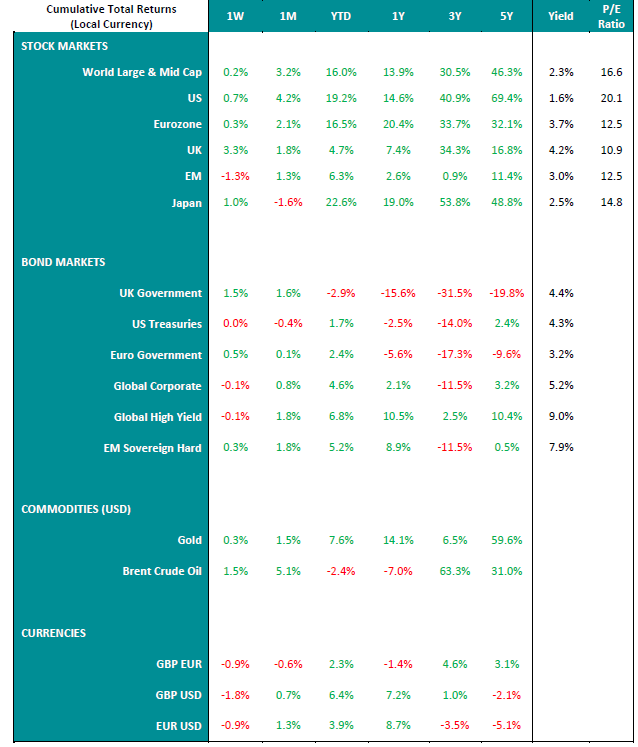

Market Performance

Data as of 21/07/2023. Source: Bloomberg. Note: The Yield and P/E figures for stock markets respectively use 12m forward dividends and earnings divided by the index’s last price. For bond markets, the yield to maturity is used.

Past performance is not a reliable indicator of future returns.

Important Information

Information correct as of 24 July 2023.

This document is designed as marketing material. This document has been composed by Brown Shipley & Co Ltd ("Brown Shipley”). Brown Shipley is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales No. 398426. Registered Office: 2 Moorgate, London, EC2R 6AG.

This document is for information purposes only, does not constitute individual (investment or tax) advice and investment decisions must not be based merely on this document. Whenever this document mentions a product, service or advice, it should be considered only as an indication or summary and cannot be seen as complete or fully accurate. All (investment or tax) decisions based on this information are for your own expense and for your own risk. You should (have) assess(ed) whether the product or service is suitable for your situation. Brown Shipley and its employees cannot be held liable for any loss or damage arising out of the use of (any part of) this document.

The contents of this document are based on publicly available information and/or sources which we deem trustworthy. Although reasonable care has been employed to publish data and information as truthfully and correctly as possible, we cannot accept any liability for the contents of this document, as far as it is based on those sources.

Investing involves risks and the value of investments may go up or down. Past performance is no indication of future performance. Currency fluctuations may influence your returns.

The information included is subject to change and Brown Shipley has no obligation after the date of publication of the text to update or amend the information accordingly. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it.

This is non-independent research and it has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

All copyrights and trademarks regarding this document are held by Brown Shipley, unless expressly stated otherwise. You are not allowed to copy, duplicate in any form or redistribute or use in any way the contents of this document, completely or partially, without the prior explicit and written approval of Brown Shipley. Notwithstanding anything herein to the contrary, and except as required to enable compliance with applicable securities law. See the privacy notice on our website for how your personal data is used (

https://brownshipley.com/en-gb/privacy-and-cookie-policy).

© Brown Shipley 2023

.png?width=650&resizemode=force)