This note contains an overview of our market views, what we are watching, and our portfolio strategy. These developments may not mean changes to your portfolio so please contact your Client Advisor for the latest update on your portfolio.

Markets at a glance

- The weekend saw the news of potential instability in Russia, with a brief mutiny of a paramilitary faction. While the situation now appears to have tentatively stabilised, at least taken at face value, we continue to be on the lookout for any geopolitical ramifications, along with any possible tensions with the US and Europe this seems to create every now and then.

- Many equity markets saw their winning streaks come to an end last week, with each major index reporting mild losses across the week following some surprising economic data and central bank announcements. The start of this week appears to be on the weak side too.

- Monetary policy continues to take centre stage. In the UK, the Bank of England (BoE) raised interest rates by 50 basis points following a reacceleration in core inflation (which excludes volatile components such as energy and food). This was a larger increase than markets expected. The latest report showed price pressures across the board and data suggesting a tight labour market with strong wage growth.

- This casts doubts on whether the BoE will be able to pause its rate increase cycle as the US Federal Reserve (Fed) did following its last meeting to assess the impact on the economy. We expect another UK rate increase at the next meeting, likely followed by at least one more this year.

- While additional interest rate increases squeeze incomes and put downward pressure on the housing market, we believe that the BoE has no choice other than engineering extra economic weakness to curb what now looks like self-sustaining inflation. In Norway, the central bank surprised the market and hiked by 50 basis points too.

- In the US, the Fed stuck to its guns on its view to further increase interest rates, with Chair Powell stressing to Congress that the inflation battle is not over yet. It seems that markets are sceptical on this view as interest rates expectations haven’t changed, with just one more 25 basis-point increase anticipated.

- While geopolitical risk lingers in China, the People’s Bank of China (PBoC) followed up with more interest rate cuts to boost the economy. The stronger than expected inflation data from Japan weighed on the Japanese equity market.

- This week, investors are likely to turn to inflation data for the Eurozone, which is anticipated to have continued to ease in June (although we see risks that core inflation could come in higher than expected), underscoring our view that the European Central Bank (ECB) is close to pausing its monetary policy tightening cycle. Investors are also likely to scrutinise any hint from the ECB Forum of central bankers later this week, which will see a panel of heads of the Fed, ECB, BoE and the Bank of Japan.

Portfolios at a glance

Here’s how we’re positioned in our flagship portfolios:

- Even though volatility has picked up in recent days, market falls have been relatively contained as mentioned above. Changes made to our flagship portfolios earlier this quarter were designed to brace for possible market turbulence by locking in profits from segments showing strong performance, particularly those where valuations seemed overstretched.

- Meanwhile, we have been shifting towards low-volatility stocks in Europe, which carry more defensive characteristics. At the same time, we have recently added to our US investment grade corporate bond exposure, as we have more confidence that the peak in interest rates is closer in the US relative to other regions.

- After a sharp rebound in most risky assets this year, we believe a cautious approach is warranted given the macroeconomic and market uncertainty that may arise. This is why we continue to own more high-quality bonds versus our long-term asset allocation, and slightly less equity and riskier bonds.

- Furthermore, our portfolio holdings remain biased towards investments which we believe demonstrate solid long-term growth prospects, strong balance sheets, and attractive valuations. These attributes can serve as a buffer in the event of a reversal in market sentiment.

Past performance is not a reliable indicator of future returns.

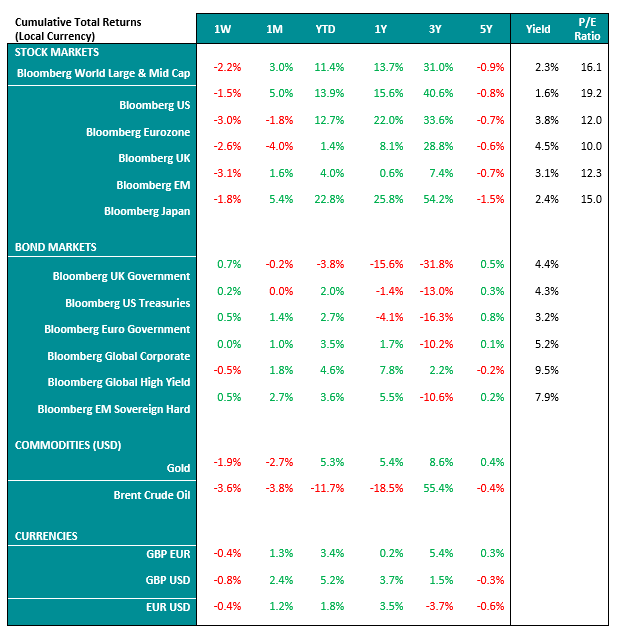

Market Performance

Data as of 23/06/2023. Source: Bloomberg. Note: The Yield and P/E figures for stock markets respectively use 12m forward dividends and earnings divided by the index’s last price. For bond markets, the yield to maturity is used.

Past performance is not a reliable indicator of future returns.

Important Information

Data as of 23/06/2023. Source: Bloomberg. Note: The Yield and P/E figures for stock markets respectively use 12m forward dividends and earnings divided by the index’s last price. For bond markets, the yield to maturity is used.

Past performance is not a reliable indicator of future returns.

Important Information

Information correct as of 23 June 2023.

This document is designed as marketing material. This document has been composed by Brown Shipley & Co Ltd ("Brown Shipley”). Brown Shipley is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales No. 398426. Registered Office: 2 Moorgate, London, EC2R 6AG.

This document is for information purposes only, does not constitute individual (investment or tax) advice and investment decisions must not be based merely on this document. Whenever this document mentions a product, service or advice, it should be considered only as an indication or summary and cannot be seen as complete or fully accurate. All (investment or tax) decisions based on this information are for your own expense and for your own risk. You should (have) assess(ed) whether the product or service is suitable for your situation. Brown Shipley and its employees cannot be held liable for any loss or damage arising out of the use of (any part of) this document.

The contents of this document are based on publicly available information and/or sources which we deem trustworthy. Although reasonable care has been employed to publish data and information as truthfully and correctly as possible, we cannot accept any liability for the contents of this document, as far as it is based on those sources.

Investing involves risks and the value of investments may go up or down. Past performance is no indication of future performance. Currency fluctuations may influence your returns.

The information included is subject to change and Brown Shipley has no obligation after the date of publication of the text to update or amend the information accordingly. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it.

This is non-independent research and it has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

All copyrights and trademarks regarding this document are held by Brown Shipley, unless expressly stated otherwise. You are not allowed to copy, duplicate in any form or redistribute or use in any way the contents of this document, completely or partially, without the prior explicit and written approval of Brown Shipley. Notwithstanding anything herein to the contrary, and except as required to enable compliance with applicable securities law. See the privacy notice on our website for how your personal data is used

(

https://brownshipley.com/en-gb/privacy-and-cookie-policy).

© Brown Shipley 2023

.png?width=650&resizemode=force)