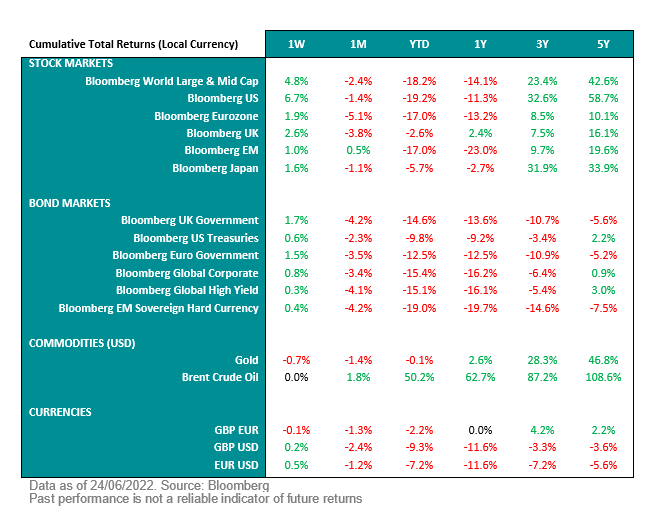

Markets at a glance

Recent developments (See Market Return Table)

- Global equities posted a 4.8% gain last week, we believe this is likely to have been boosted by falling expectations of how much the Fed will raise rates this year as the economy cools. The yield on the US 10-year government bond ended last week at 3.13%, down nearly 0.4% from its 11-year high on 14 June.

- Equities outperformed bonds last week, while commodity prices cooled and inflation expectations moderated. Within equities, the main theme was the falls seen in energy and materials. Within bonds, government debt outperformed credit as the yield gap between credit and government debt widened.

- Before the US Congress, Fed Chair Powell reaffirmed the central bank’s commitment to curb inflation. Referring to a resilient economy, he also acknowledged that a recession is possible. Other Fed officials backed a 75 bps rate hike for July, which is now the most likely outcome.

- US new home sales surged by 10.7% in May, well ahead of consensus although financial conditions have tightened further since May as mortgage rates jumped to 5.8%, the highest level in 14 years.

- Purchasing managers’ indices (PMIs) for June fell more than expected both in the euro area and in the US, pointing to still positive but slower growth. UK numbers remained stable.

- The German Ifo business climate declined more moderately, but the survey was taken before Russia’s squeeze to gas deliveries. Taken at face value, this may raise recession risks in Germany.

- Given Russian gas disruptions, the German government’s ‘alert declaration’ in its emergency plan could result in gas rationing. Berlin called for saving energy, while the US proposal to cut federal taxes on gasoline (if approved) could mitigate some of the energy squeeze.

- UK headline inflation reached a 40-year high of 9.1%. Core inflation (ex food and energy), fell for the first time since September 2021 to 5.9%. We expect a peak towards year-end as demand slows and supply is gradually repaired.

The week ahead:

- We believe the PMIs for China (Thursday, Friday) should improve following partial reopening, while the US ISM (Friday) is likely to show slower but still positive manufacturing activity. Thursday’s US core PCE inflation (ex food and energy), the Fed’s preferred measure, will be key to assess any pointing to a tentative peak in US inflation. Euro area inflation (Friday) should accelerate, mostly driven by energy. Oil prices, though, have been declining recently. Russian gas rationing remains a key risk.

Asset allocation and portfolio views

.PNG)

- Your Portfolio is managed according to its objectives. The bedrock of portfolio management is what we believe is an optimal strategic asset allocation, which remains stable through time and drives 80-90% of outcomes. In addition, a selective tactical asset allocation overlay and both fund and equity selections aim to produce the remaining 10-20% of returns.

- In our view, 2022 has seen a reset in asset prices following 1) a number of exogenous shocks (Russia/Ukraine, China lockdowns) and 2) a normalisation of economic/earnings growth after super-strong rates. Our research shows that this is not the end of the cycle, and we therefore maintain a small tactical overweight position in US equities versus investment-grade bonds.

- We have recently made one change to our tactical positioning as we lowered our conviction in Asia High Yield. This has been a disappointing position in the portfolio. However, fundamentals have changed, with the efforts of the Chinese government to support property issuers falling short of our expectations, and there remain signs of contagion in this segment of the market. Updating our forecasts incorporating increased default expectations, we now see limited upside to the position.

Our investment strategy pillars

- We remain disciplined and focused on the long-term objectives. We will not let short-term market moves and temptations to time the market get in the way of the potential benefits of long-term investing. Even though market conditions have been challenging for our strategy this year, we believe in the long-term merits of each of our pillars and maintain conviction in their ability to help drive portfolio performance in the future

- We invest globally, within equities and bonds, which gives access to a wide pool of potential growth, income drivers and exposures.

- We invest in companies with quality growth characteristics, those with competitive franchises, pricing power, and high returns on capital. Even though these companies have not been rewarded in the last six months, our research shows that they remain well positioned for the future.

- We invest in an increasingly sustainable manner. We want to be ahead of the curve by backing assets with high or improving social, governance and environmental standards.

In a year where there has been no place to hide, your portfolio holds assets whose prices have fallen but, we believe, whose potential future value has increased given their unchanged expected long-term characteristics. We therefore maintain conviction in the return potential of the portfolio.

Market Performance

Bill Street

Group Chief Investment Officer

Important Information

Non-Independent Research

The information contained in this article is defined as non-independent research because it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research, including any prohibition on dealing ahead of the dissemination of this information.

How to Use this Information

This article contains general information only and is not intended to constitute financial or other professional advice or a recommendation that any recipient of this information should make any particular investment decision. Always consult a suitably qualified financial advisor on any specific financial matter or problem that you have.

Except insofar as liability under any statute cannot be excluded, neither Brown Shipley nor any employee or associate of them accepts any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in this article or for any resulting loss or damage whether direct, indirect, consequential or otherwise suffered by the recipient of this article.

Investment Risk

Investing in stocks either directly or indirectly carries investment risk. The value of equity based investments may go down as well as up over time due to factors such as, market volatility, interest rates, and general economic conditions.

Information correct as at 27 June 2022.

Past performance is not a reliable indicator of future returns

© Brown Shipley 2022 reproduction strictly prohibited.

.png?width=650&resizemode=force)