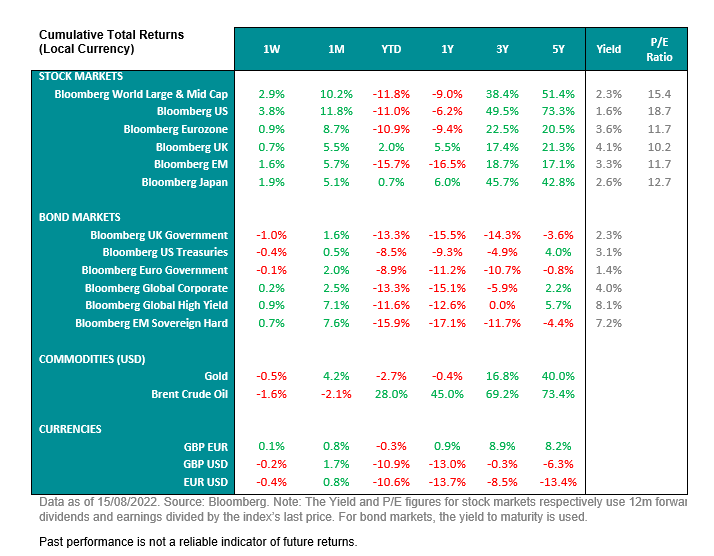

Markets at a glance

Markets – Guessing what the Fed will do in September

- The rally in risk assets has extended to the second week of August. The S&P 500 returned 3.3%, the tech-heavy Nasdaq 2.7%. But European and emerging market equities, while rising, slightly underperformed their US peers with the Stoxx Europe 600 up only 1.3%, the UK’s FTSE 100 up 1.2% and the MSCI Emerging Markets index up 1.7%.

- It’s probably too soon, but markets already await a potential pivot from the US Federal Reserve (when the Fed starts to signal that the next direction for rates is down). As such, market volatility is likely around key economic releases, as was the case with the US labour report and the latest inflation update. In addition, markets have been quick to reprice policy expectations as central banks have abandoned forward guidance.

Past performance is not a reliable indicator of future returns.

Central banks – Data dependence

- Lower energy prices drove a bigger-than-expected decline in US headline inflation for July (to 8.5% year-on-year from 9.1% the previous month), as well as producer prices. Markets are now pricing a c.60 bps interest rate hike in September, rather than a third consecutive 75 bps increase (which was the case post the US labour report).

- Various Fed speakers warned of the market’s optimism as higher terminal rates remain possible - the US central bank needs more evidence that inflation is falling.

Economy – Resilient US economy; energy crisis worsens in Europe

- The US economy remains resilient: it added 528,000 jobs in July, considerably exceeding expectations (250,000), while the rotation from goods to services continues with ISM Services rising significantly to 56.7 (and surprising to the upside). ISM Manufacturing edged slightly lower to 52.8.

- Natural gas and electricity prices continued to soar in Europe – December 2022 electricity futures rose well past EUR 500 / Mwh (vs sub 50 two years ago). Extreme weather conditions (e.g., low water levels in the river Rhine) put further strain on regional supply chains.

- China’s external sector is at record highs (first ever USD100bn+ trade surplus reported) but industrial production and retail sales rose less than expected in July.

The week ahead

- After last week’s notable decline in US headline inflation, investors will scrutinise the Fed’s minutes (Wednesday) looking for additional clues for the September meeting.

- Also from the US, industrial production (Tuesday) but mainly housing starts (Tuesday) and retail sales (Wednesday) will be scrutinised to assess the resilience of the domestic economy.

- In contrast, UK headline inflation (Wednesday) is estimated to have increased to 9.8%, inching closer to the Bank of England’s projection of double-digit inflation later this year – core inflation is expected to reach 5.9%. As such, increased living costs could put further pressure on UK consumer confidence and retail sales (both Friday).

Tactical asset allocation

.PNG)

- We recently reduced our equity position to neutral – in other words to its long-term strategic position - to reflect the uncertainty around the outlook for equity markets and more favourable bond yields. The more cautious stance is warranted at a time where we observe macro cross currents (growth vs. inflation) and lack of clear direction in financial markets.

- In such a highly uncertain environment, we continue to focus on exploiting opportunities selectively within asset classes ahead of a clear trend emerging.

- In our case, we are overweight US equities and emerging market equities versus eurozone equities. Elsewhere, we remain overweight EM sovereign bonds (USD-denominated) vs developed market (UK and EU) government bonds given the attractive yields of EM sovereign bonds of which we think well compensate the additional risk factor.

- As always, we continue to assess the opportunity set for potential new tactical positions.

Investment strategy

- The second half of 2022 continues to see a general improvement in the absolute performance of model portfolios, although overall 2022 returns remain negative. Longer term, 5-year returns remain positive.

- The positive momentum from July has fed through into August, with our global approach to asset allocation in portfolios continuing to be a tail wind to recent performance. More specifically, our overweight to US equities has helped performance with our view being that recessionary risks in the region remain lower, especially compared to eurozone equities.

- Further ahead, we remain disciplined and focused on the long-term objectives, maintaining conviction in our investment strategy pillars: 1) global approach to asset allocation 2) increasingly sustainable approach and 3) quality growth-biased investments, all of which we believe should be rewarded in the long run.

Market Performance

Important Information

Non-Independent Research

The information contained in this article is defined as non-independent research because it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research, including any prohibition on dealing ahead of the dissemination of this information.

How to Use this Information

This article contains general information only and is not intended to constitute financial or other professional advice or a recommendation that any recipient of this information should make any particular investment decision. Always consult a suitably qualified financial advisor on any specific financial matter or problem that you have.

Except insofar as liability under any statute cannot be excluded, neither Brown Shipley nor any employee or associate of them accepts any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in this article or for any resulting loss or damage whether direct, indirect, consequential or otherwise suffered by the recipient of this article.

Investment Risk

Investing in stocks either directly or indirectly carries investment risk. The value of equity based investments may go down as well as up over time due to factors such as, market volatility, interest rates, and general economic conditions.

Information correct as at 16 August 2022.

Past performance is not a reliable indicator of future returns

© Brown Shipley 2022 reproduction strictly prohibited.

.png?width=650&resizemode=force)