What you need to know

- We believe 2023 will be a year of (almost) two halves:

- First, we expect a recession mostly in UK and Europe and a mild one in the US, driven by more, but final interest rates hikes, elevated inflation across the developed world, and energy headwinds in Europe.

- Then, new economic cycles should emerge from the second quarter. As inflation slows down but still remains high, we expect central banks to pause rate increases. The recovery in Europe and the UK will likely lag behind the US, whilst China’s economy should reaccelerate following the removal of zero-Covid.

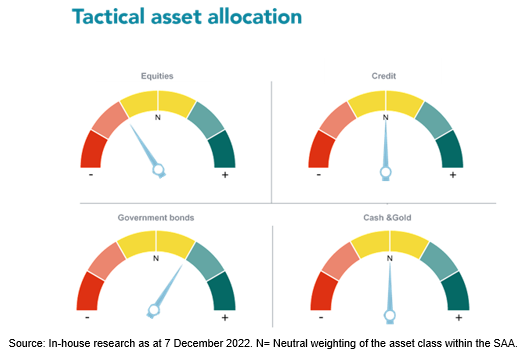

- We believe now is not the time to make notable directional calls on markets. Instead, we are focusing more on specific convictions within asset classes at this stage, while keeping a close eye on the catalysts that could make investor sentiment shift.

- We start 2023 with a well-diversified mix of equity and fixed income exposures, aiming to benefit from markets upswings while also providing a cushion for unexpected large market drawdowns. As 2023 begins, we

- increase government bonds and high-quality non-US corporate bonds,

- reduce US high yield, US investment grade bonds and US dollar cash, and

- increase exposure to low-volatility and high dividend equities.

Big Picture

We expect the world economy to continue to slow in the beginning of 2023, with regional recessions (mostly in UK and Europe). We think that a peak in inflation, combined with China’s moderate rebound, will lead to some stabilisation in growth from next spring, with a relatively modest recovery after the summer. Three shifts will, in our view, contribute to this.

- Inflation: US inflation will move past the peak and decelerate first, followed by Europe, albeit still remaining above pre-Covid levels.

- Rates: Developed Market central banks will stop raising rates and turn more prudent in their communication, particularly once the Fed announces a pause to rate increases. EM central banks could be the first to cut interest rates - they were the first to raise them in this cycle.

- China: Growth will pick up with Beijing moving away from their zero-Covid policy and adding extra stimulus.

What’s changing?

Our investment views:

- We are mindful that uncertainty will remain high in 2023 and head into the year with a mix of new fixed income and equity exposures, whilst maintaining some of the views we held during 2022.

- As we expect inflation to moderate and central banks to pause interest rate hikes during the first part of 2023, markets could rally around more attractive valuations. However, all conditions for a broad-based rally are not met just yet given the ongoing economic slowdown and elevated uncertainty.

- Therefore, we are not changing our aggregate equity exposure yet. Instead, we are making changes within the asset classes.

Fixed income:

- We are increasing our exposure to high-quality bonds given attractive risk-rewards.

- A greater proportion of our bond exposure is now tilted towards more traditional and higher quality sovereigns like US Treasuries and local government bonds (EU/UK), and away from riskier, higher-yielding bonds.

Equities:

- We are adding new equity positions that we view as diversifiers, i.e. positions that can also perform well in market conditions outside of our baseline hypothesis.

- While we are keeping our large cap and quality growth bias compared to the market, this is moderated by an increased exposure to low-volatility and high-dividend US stocks.

- These positions mostly bring some defensiveness at the sector level (utilities, consumer staples) but also adds some selective cyclical exposure (financials, industrials).

More detail on our tactical positioning

Fixed Income – The year of the yield

Bonds are attractive again following a steep rise in yields in 2022. As growth slows and inflation eases, we believe interest rates and bond yields, currently at compelling levels, should peak. So we position as follows:

- Reduce US high-yield and investment-grade bonds as spreads (the difference in interest rates between two bonds – or bond classes - with different credit ratings) look too tight. However, these may widen on any sustained period of economic weakness or restrictive interest rate environment.

- Increase US Treasuries, European & UK government bonds and high-quality European & UK corporate bonds using the cash proceeds from the above reduction.

- Maintain our EM hard currency sovereign bond exposure as spreads are wide and offer a suitable alternative to other high yield corporate bonds, which have a lower credit rating. In addition, China reopening alongside falling global inflation and EM central banks completing their hiking making real interest rates attractive are all positive catalysts.

Equities –

Equity valuations improved in 2022, but growth matters.

As previously mentioned, conditions for a broad-based rally are not met yet. This underscores our selective approach. Despite our asset allocation changes, our overall equity exposure remains slightly reduced versus our long-term strategic asset allocation. Therefore, we:

- Maintain our overweight US and EM over European equities due to the difference in earnings trends and valuations. EM equities, despite recovering slightly, still offer very attractive risk-rewards. US equities, despite correcting in 2022, are still trading at elevated valuations, but the high-quality nature of the market coupled with the resilience of the US economy relative to peers are all compelling reasons to continue to own this market.

- Increase exposure to low-volatility and high-dividend equities. As history shows, they both tend to perform well around peaks in interest rates. We lean towards their high-quality nature, and believe they also have the additional benefit of offering a hedge to either higher rates or lower growth.

Cash & Gold – A weaker USD, but not by much

We believe the US dollar strength should continue to wane and then weaken, but the rebound of the EUR and GBP will likely be capped. This is due, in our opinion, to growth headwinds, the energy risk premium for Europe, and all central banks pausing interest rate increases. In short, we:

- Reduce US dollar cash, redeploying towards more attractive safe-haven assets, such as US Treasuries (see fixed-income section above).

- Maintain our long-term strategic gold exposure as another diversifier. The Fed moving closer to this holding pattern on interest rates and a depreciation of the USD should be supportive of gold. But any upside may be limited (especially considering such a volatile asset), and yielding assets are more competitive.

If you have any questions about our latest market views or the changes in your portfolio, please speak to your client advisor who will be happy to help.

Important Information

Non-Independent Research

Important Information

Non-Independent Research

The information contained in this article is defined as non-independent research because it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research, including any prohibition on dealing ahead of the dissemination of this information.

How to Use this Information

This article contains general information only and is not intended to constitute financial or other professional advice or a recommendation that any recipient of this information should make any particular investment decision. Always consult a suitably qualified financial advisor on any specific financial matter or problem that you have.

Except insofar as liability under any statute cannot be excluded, neither Brown Shipley nor any employee or associate of them accepts any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in this article or for any resulting loss or damage whether direct, indirect, consequential or otherwise suffered by the recipient of this article.

Investment Risk

Investing in stocks either directly or indirectly carries investment risk. The value of equity based investments may go down as well as up over time due to factors such as, market volatility, interest rates, and general economic conditions.

Information correct as at 8 December 2022.

Past performance is not a reliable indicator of future returns

© Brown Shipley 2022 reproduction strictly prohibited.

.png?width=650&resizemode=force)