What you need to know

- Our Counterpoint 2022 suggests that two positive market drivers – economic growth and policy support – should both peak and become less positive this year. But two negative market drivers – high inflation and the Covid-19 fallout – are likely to peak and become less negative as well. The macro backdrop supports equity prices and bond yields both rising.

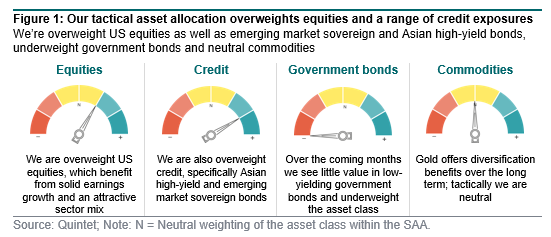

- We maintain our tactical US equity overweight. The strong market recovery of 2021 is behind us and corporate earnings growth has probably peaked. But the cycle isn’t ending and earnings are likely to stay solid. The US consumer balance sheet is healthy, and pricing power is particularly strong among large US tech firms, which can defend high profit margins.

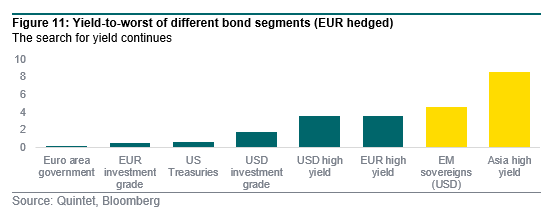

- While we think global interest rates should move further off their lows this year, finding attractive yield in bonds remains a challenge. So we look for carry in segments that, in our view, compensate well for their credit risk. The highest yields are currently found in emerging market sovereign and Asian high-yield bonds, which we overweight over lower-yielding bonds.

We’re starting the year by maintaining our risk-on tactical asset allocation, which overweights US equities as well as emerging market sovereign and Asian high-yield bonds over low-yielding sovereign and investment grade bonds (figure 1). While the early recovery phase of the cycle – with its outsized equity gains – is behind us, we think the cycle is not at its end. Equities are still likely to outperform bonds during this phase, and the US market offers superior domestic growth dynamics and an attractive mix of cyclical, defensive and technology companies. We are also maintaining our preference for USD over EUR denominated bonds, due to the yield advantage (even after hedging the currency risk). In addition, USD bonds tend to hold their value better through periods of market volatility.

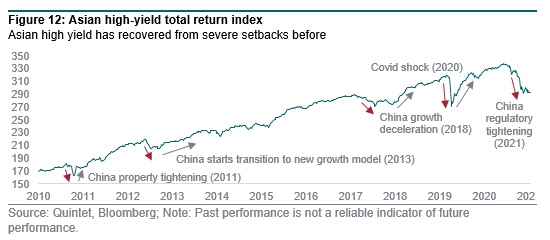

Unlike other credit markets, Asian high-yield bonds have come under pressure in 2021, with spreads widening significantly, and had a poor start into the new year too. Investors priced in the risk of a default wave sweeping across China’s property sector, implying more than a third of companies entering into bankruptcy. Such an outcome looks too dire to us, given the systemic risks it would pose to the Chinese economy. Corroborating our view that policymakers would cushion the inevitable slowdown, the Chinese government eased certain restrictions while the central bank loosened policy. We’re well aware of the risks in the months ahead, but continue to think this asset class offers an attractive risk-return profile over the next 12 months, thanks to its high carry and our expectation for spreads to tighten.

Two macro positives are peaking: growth and stimulus

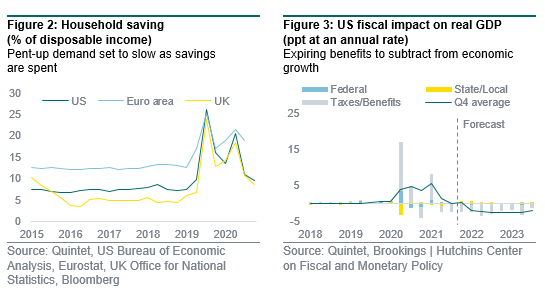

We think economic and earnings growth is moving past the peak. It’s unlikely to slow sharply just yet – as past stimulus continues to feed through and, once Omicron subsides, economies should reopen more fully. But the savings accumulated during the lockdowns, given constraints to spend on services and emergency cheques coming in, are now being partly spent (figure 2). So consumers’ spending power should be lower. US fiscal policy is likely to subtract from GDP growth going forward (figure 3). This is mostly because of a decline in federal transfers as the unemployment insurance benefit expansions and the rounds of rebate cheques ended, plus a reduction in federal non-defence purchases after the expiration of the loan programme to help small businesses continue paying their workers.

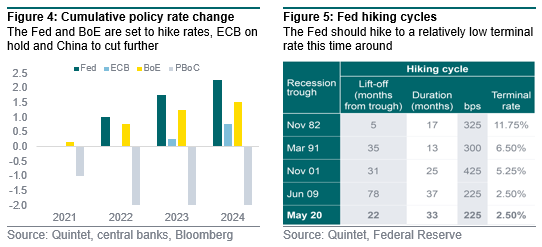

Central bankers are likely to be busy in 2022 (figures 4 and 5). The Fed (from April) and the Bank of England (starting this month) should stop their net asset purchases and hike rates from record lows. This year, the Fed is likely to hike three or four times for a total of 75 to 100 bps, and to keep hiking at a similar pace next year. The Bank of England, which already hiked in December 2021, is likely to hike two or three times in 2022 for a total of 50 to 75 bps, and then continue hiking in 2023. It will likely take 18 months for the US and about 6 months for the UK to raise the key policy rate to pre-Covid levels – which were still low. Both central banks are also likely to start shrinking their balance sheets. The ECB is unlikely to stop its net asset purchases or hike in 2022. The People’s Bank of China is cutting rates and easing financing conditions.

Two macro negatives peaking later: inflation and virus impact

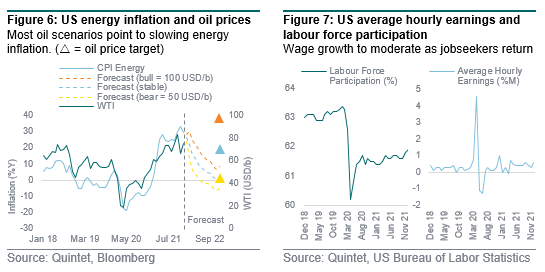

The inflation spike has proven more enduring than initially hoped but, to us, it remains a spike nonetheless. It should moderate this year as energy inflation slows (figure 6). Oil prices surged from a low of USD 20 per barrel to more than USD 75 at end-2021, pushing up US energy inflation to more than 30% year-on-year. Even if they were to rise to USD 100, the rate of energy inflation would drop to 6% by December. If oil prices were to stabilise around current levels, we would expect it to return towards zero. We’ve also seen an acceleration in wage growth, driven by lower-wage industries most impacted by the pandemic (figure 7). But further wage growth should be tempered by a gradual return of workers from the sidelines. Slowing economic growth and policy tightening should contribute too.

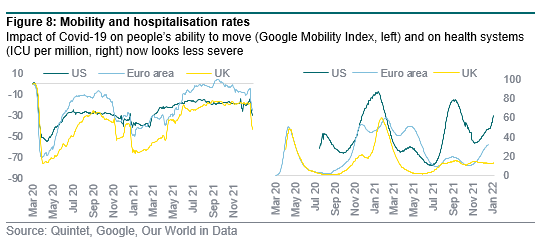

Another case of a negative becoming less negative is the Covid-19 impact (figure 8). The recent virus variants, while more infectious, seem less virulent and they’re resulting in fewer disruptions to economic activity. As a result of Omicron, mobility is falling once again. The data also show, however, that the impact of each new wave is becoming less strong. While intensive care unit occupancy has risen in the US and the euro area, this was still partially due to a higher presence of the Delta variant. In the UK, where Omicron has been dominant for longer, the number of severe cases is nowhere near past peaks. Fewer virus problems should help repair supply chains, especially in emerging markets, where vaccination rates are still low but progressing. In turn, this too should help ease the inflation spike.

US equities remain in the lead

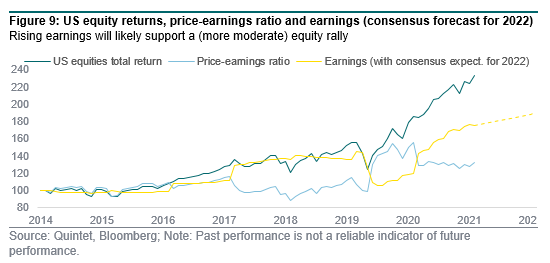

As the global economy is moving past the peak in terms of growth, so are corporate earnings. But the equity cycle is not at its end. Conditions remain generally supportive, even as the stellar recovery of 2021 moves into the rear-view mirror. Consumers, especially in the US, can rely on strong balance sheets and they are likely to keep spending as Covid either retreats or we learn to live with it. Meanwhile, many companies proved last year that they can defend high profit margins even in the face of elevated inflation. Among larger US tech firms pricing power is significant. Consequently, earnings growth should remain solid in 2022 (figure 9). On average analysts expect a growth rate of around 10% for the year – somewhat above the 30-year average. Over the same period US equities returned 11% annually.

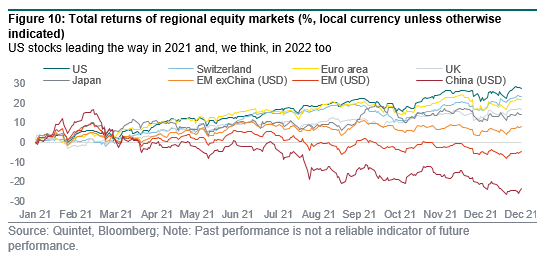

Risks to our constructive outlook include a worsening of the pandemic forcing full-scale lockdowns and, therefore, weakening economic activity. However, we believe that, should growth slow significantly, fiscal and monetary stimulus will likely increase, providing some support to asset prices. Our base case does foresee retreating policy support this year. But investors have already priced in three to four Fed rate hikes for 2022, so only a more hawkish outcome should be a headwind for stocks. Overall, we expect US stocks to continue to outperform bonds, albeit at a slower pace than last year, and keep our tactical overweight. With total returns of 26%, the US left behind all other regions in 2021 and we think its strengths leave it well positioned at the start of the new year too (figure 10).

Carry is king even as yields move off the lows

While global rates should further move off their lows this year, finding attractive yield in bonds remains a challenge (figure 11). So we look for carry in segments that compensate well for their credit risk. The highest yields are currently found in emerging market (EM) sovereign and Asian high-yield bonds, which we overweight over lower-yielding bonds. Some EM countries are experiencing severe challenges. Turkey is in the midst of a currency crisis and many African countries are suffering from the pandemic as vaccination rates are still low. Nevertheless, EM bonds weathered the turbulence of 2021 reasonably well, performing roughly in line with US Treasuries. For 2022, we expect spreads to remain range-bound and carry – 4.5% (in EUR) currently – to be a key driver of performance.

Asian high-yield bonds have suffered their worst year in a decade in 2021, mainly due to regulatory tightening, which heavily weighed on Chinese real estate developers (figure 12). As a result of the correction, current valuations are attractive, with an average yield of 10% (in EUR). Risks are adequately priced, in our view, and tentative signs of stabilisation are emerging. The Chinese government has taken steps to ease funding conditions, at least for solvent property firms, generally taking a more dovish stance towards the sector lately. Some major defaults materialised late last year (e.g., Evergrande and Kaisa), eventually allowing investors to regain confidence in the remaining (more solid) firms and clearing the way for spreads to tighten. We still expect defaults to remain elevated through 2022, but asset-class returns are likely to recover from the 2021 sell-off.

Looking forward

You can find out more about our views for the year ahead in Counterpoint 2022. Our investment experts share their views on financial markets and investing, as well as the themes we think will drive tomorrow’s economy – from sustainability issues and the fight to mitigate climate change to the ongoing digitalisation of many aspects of our lives.

Important Information

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 17 January 2022, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2022. All rights reserved.

.png?width=650&resizemode=force)