What you need to know

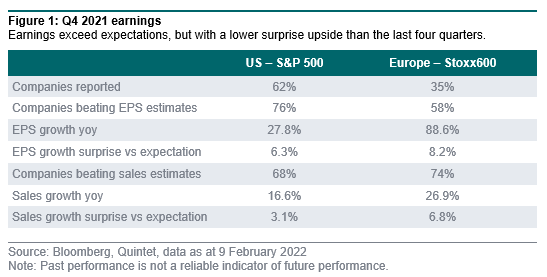

- The Q4 2021 earnings season has, so far, continued the recent positive trend with 76% of US companies and 58% of European companies exceeding expectations.

- However, the magnitude of the positive surprise (6% in US and 8% in Europe) is lower than recent quarters. This is a sign of a maturing post-pandemic recovery and of greater visibility.

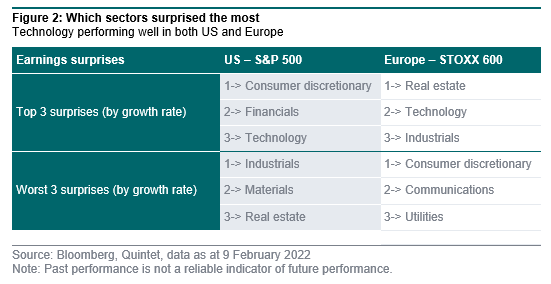

- Corporate performance within sectors is more divergent. Reasons include different business models and the timing of cost inflation and price increases. Investors should take care not to extrapolate short-term trends.

Another strong earnings season

With over half of US companies having reported, we have had results from the majority of industry bellwether stocks and therefore have a good view of how the full earnings season is likely to conclude. Of the 62% of US companies that had reported as at 9 February 2022, 76% have exceeded EPS estimates, with an average surprise of 6%. The percentage of companies exceeding estimates is in line with the long-term trend.

The average positive surprise is the lowest of 2021, reflecting the maturing of the post-pandemic recovery and greater forecasting visibility. European company announcements are at an earlier stage, with only 35% having reported. But there are similar trends with 58% exceeding EPS estimates, with an average surprise of 8%.

Year-on-year EPS growth for Q4 remains strong at 28% for the US, which marks the fourth straight quarter of earnings growth above 25%.

Information technology and communication services

Information technology and communication services

The globally important IT sector always commands a high degree of attention. Critically, the two largest companies in the world, Apple and Microsoft, delivered better-than-expected results, which exceeded on both the top and bottom line. While cost inflation and supply chain challenges are impacting elsewhere, these are largely absent from the results of these two leading companies. The semiconductor industry continues to see demand exceed supply. ASML, the leading provider of equipment to the sector, sees this imbalance remaining for some time to come.

In contrast, PayPal, a leading digital payments company, disappointed the market with its second consecutive poor statement. We are seeing signs that some companies that performed exceptionally well in the pandemic are struggling to determine underlying demand.

Communication services is home to social media and digital entertainment companies. Alphabet, parent company to Google and YouTube, produced excellent results with 32% revenue growth, and signs that the company’s innovation in AI search is improving results. In sharp contrast, Meta Platforms (formerly Facebook) delivered guidance that 2022 would be a challenging year as it adjusts its model and strategy. Netflix, another high-profile stock, also disappointed with lower subscriber growth than the market expected.

Consumer (discretionary and staples)

The two largest companies in consumer discretionary, Amazon.com and Tesla, dominate results from this sector. Amazon was expected to have a more challenging period in Q4 as e-commerce sales annualise a very strong previous year. However, the company offset any concerns with a combination of strong advertising revenues (see Alphabet and Facebook above), accelerating growth in its AWS Cloud Computing division (see Microsoft above) and a price increase announcement for its near ubiquitous Prime subscription. Tesla exceeded expectations even while navigating supply chain challenges. The company pointed to more of the same in 2022.

Within the more defensive consumer staples sector, we are seeing some interesting contrasts. Proctor & Gamble increased prices by 3% and still grew volumes by 3%. These price increases are needed to offset higher input cost inflation that would otherwise negatively impact the company’s margins. Estee Lauder, a leader in high-end cosmetics and fragrances, is seeing margins expand as it continues to recover from the challenges that impacted its business in 2020.

Financials

Banks are a focus for investors anticipating rising interest rates, but the sector’s underlying trends are mixed. The tailwind from credit write-backs is now largely complete, so banks are returning to business as usual. Here the outlook is for rising costs due to both staff remuneration (particularly in investment banking) and technology spending. While the interest rate environment may be becoming more favourable for banks, the competitive threat from new fintech entrants remains high and is likely to require increased investment to combat.

Healthcare

Many of the leading healthcare companies pre-announce their Q4 earnings ahead of the JP Morgan Healthcare conference and this provided us with insights into three general themes. First, while Covid-related revenues have been a significant boost to life science businesses such as Thermo-Fisher Scientific, the base businesses are performing very strongly. Second, the global pharmaceutical and biotechnology industries are investing in new or novel modalities to offset pricing pressure and regulatory hurdles. These new speciality products (e.g. mRNA and gene editing) require specialised manufacturing capabilities. The trend in outsourcing is expected to continue. Third, while the short term may be uncertain, the long-term outlook in China is positive, driven by the government’s focus on health, safety and infrastructure to drive GDP growth.

Industrials and materials

It’s been a similar picture to last quarter in industrials, with strong order books and revenues being somewhat offset by rising costs. This dynamic is fairly consistent across companies that have reported to date. Those with differentiated product lines are performing better as they have greater pricing power. The materials sector has been one of the weakest to date this earnings season. This broadly reflects the sector’s position in the value chain: input costs (raw materials) rise immediately, but realised sales rise more slowly. This dynamic was evident at Givaudan and Ecolab, which are two high-quality materials businesses in different markets.

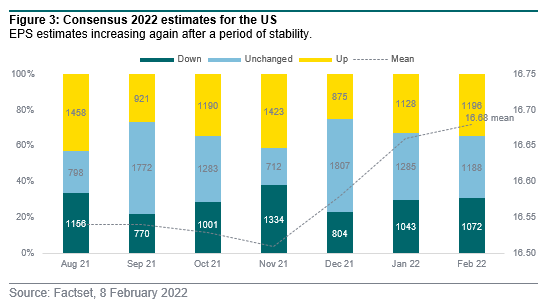

2022 earnings forecasts trending higher in both US and Europe

Consensus 2022 EPS estimates for the US market have risen over the last few months after a period of stability. This likely reflects growing comfort that the worst of the pandemic is behind us. Consensus now expects 12% growth in EPS for 2022.

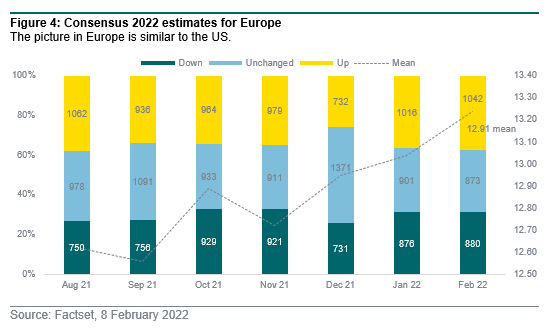

A similar picture is also emerging in Europe with 2022 EPS estimates trending higher again, and consensus expectations are for 10% growth in EPS for 2022.

Important Information

Important Information

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 14 February 2022, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2022. All rights reserved.