Private markets were once the reserve of sophisticated and institutional investors but have experienced significant growth in recent years. Now, a far broader range of private market investments are available to clients. Through our bespoke portfolios, or via our new digital platform with Moonfare, we typically advise clients to invest between 10-20% of one’s investible wealth into private markets. In this article, we cover three key reasons why we believe investors should consider incorporating private market investments into their portfolios.

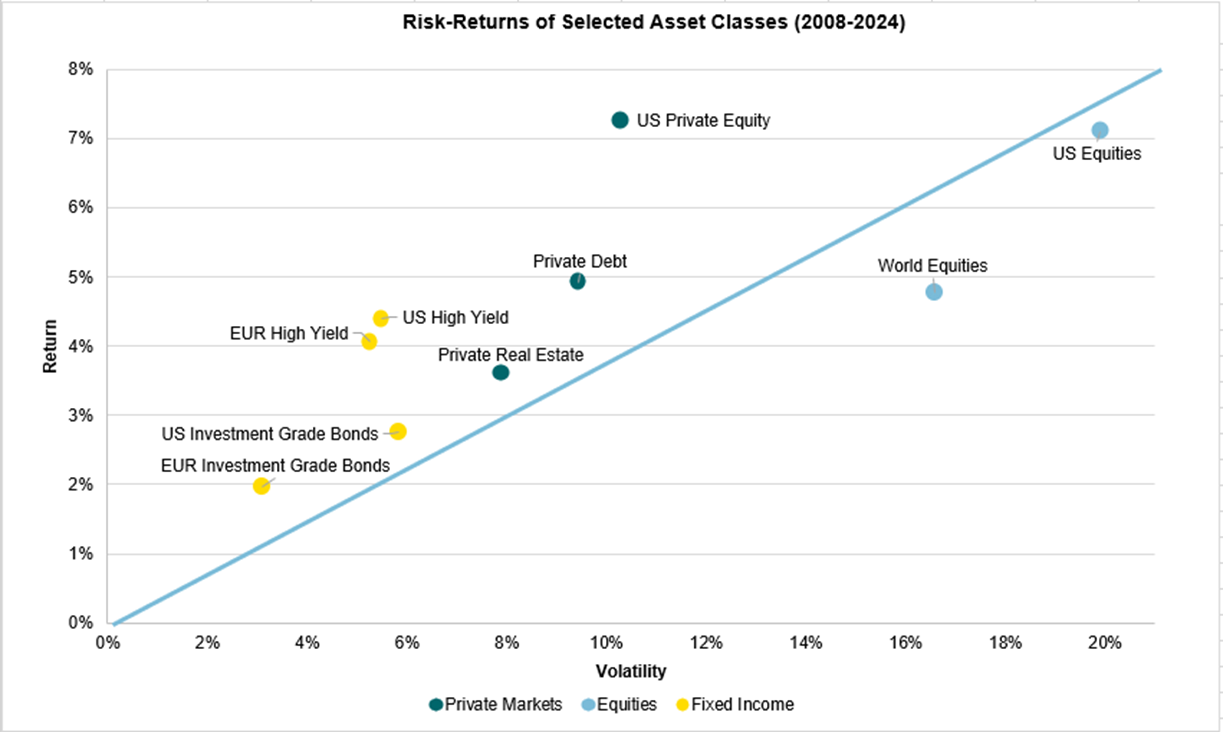

Private market investments are often not as frequently tradeable as public market investments like stocks or bonds. While some see the illiquid nature of private market as a constraint, history shows that the longer-term nature of the investments can offer the potential for reduced volatility and increased returns. This is known as the “illiquidity premium”. This premium compensates investors for the reduced liquidity compared to public markets, often leading to better returns for those who can afford to invest a portion of their capital for longer periods.

Source: In-house Research, Bloomberg. Past performance is not a reliable indicator of future performance.

Source: In-house research, Bloomberg. Past performance is not a reliable indicator of future performance.

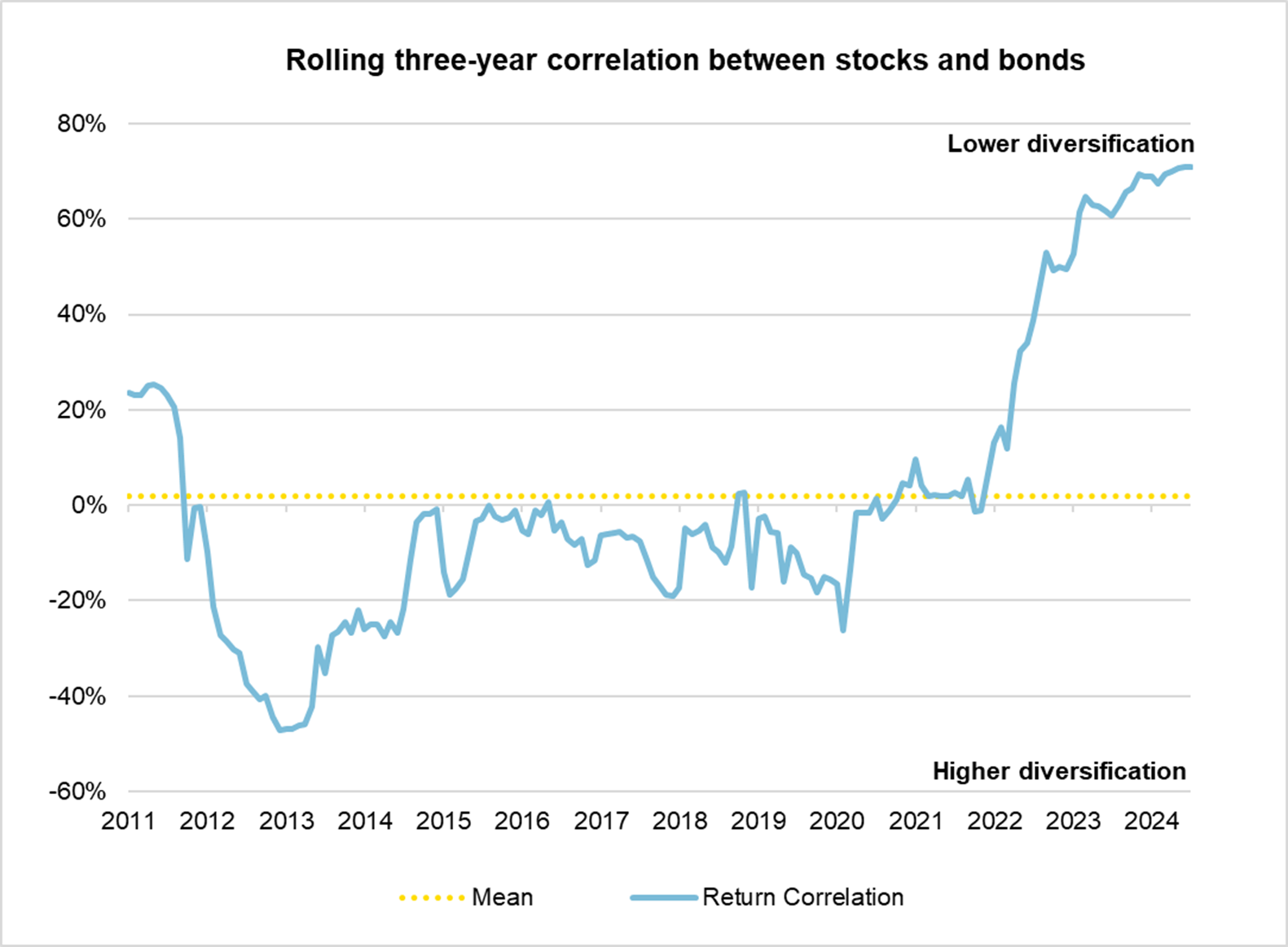

Traditionally, investors consider stocks and bonds as the foundational elements of a diversified portfolio. By investing in both, investors aim to balance the growth potential coming from publicly listed stocks with the yield and stability provided by bonds. This strategy works well in periods when stocks and bonds are not highly correlated – in other words, when one decreases in value, the other increases, balancing each other out. However, the correlation between stocks and bonds has increased in recent years as shown in the chart below. This means that both can decrease in value during periods of high market volatility.

Private markets, on the other hand, tend to have lower correlations with publicly listed markets. This means that when bonds and equities are decreasing in value, it doesn’t tend to mean private markets are also decreasing in value. Private markets can therefore help to protect long term value in portfolios in tougher times and enhance risk-adjusted returns in the long run.

Strategic solutions for long-term growth and diversification

Private Markets Opportunities

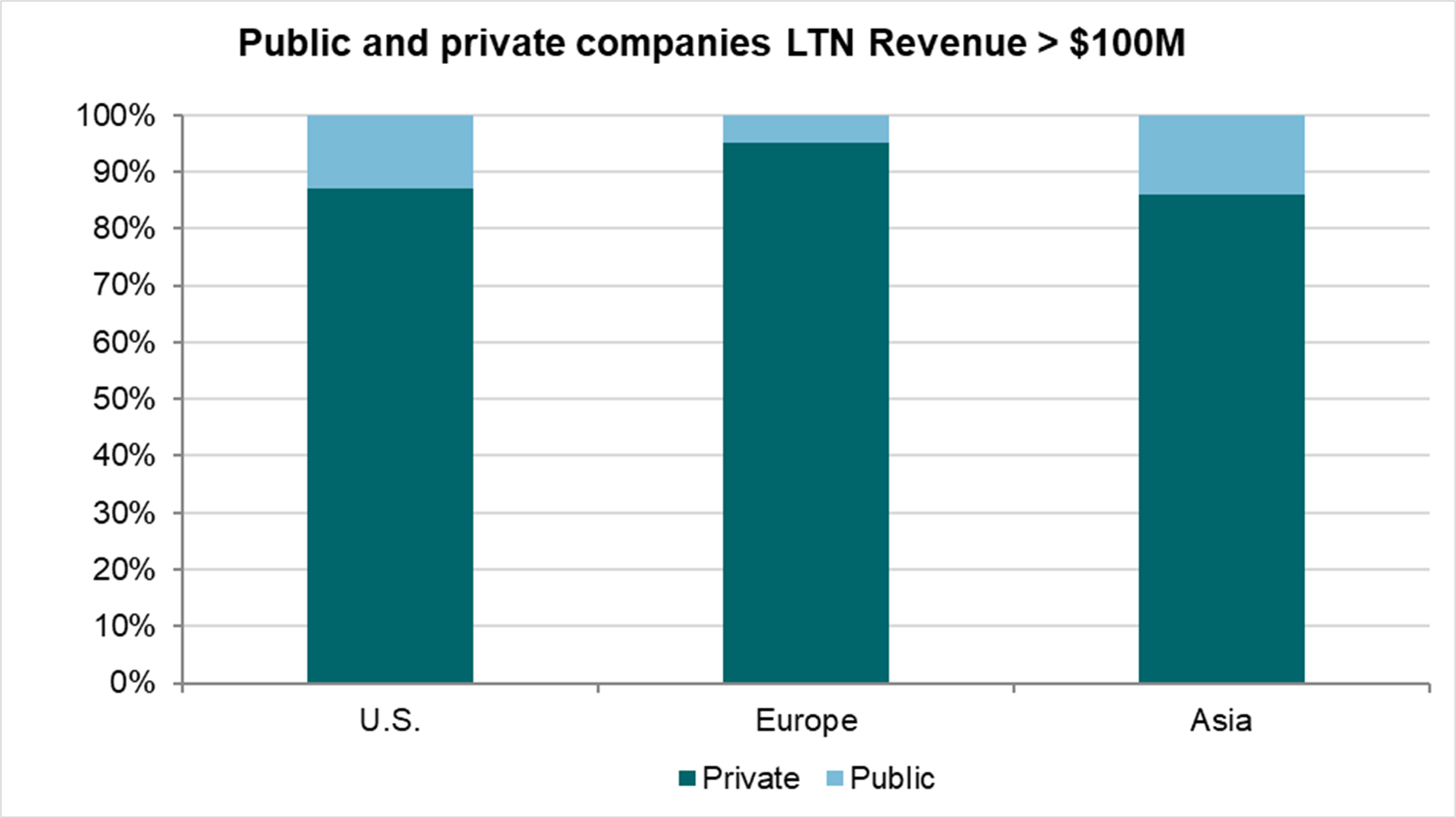

Almost 90% of large companies with over $100 million in revenue companies are not available to invest through public markets. Therefore, private markets offer access to innovative and emerging companies and sectors not yet available in public markets. This access allows investors to be part of new trends and technologies, providing a unique opportunity to benefit from higher growth and emerging trends.

Furthermore, the publicly investable market universe is shrinking rapidly. In the United States, the number of listed companies dropped from about 8,000 in the late 1990s to around 4,000 by 2020. This isn’t a uniquely US trend: we have seen similar declines in Europe and other regions around the world.

Source: Capital IQ, February 2021 - February 2022.

We believe private markets are a worthwhile part of an investor’s portfolio. They offer opportunities to enhance returns and diversification. However, investing in private markets comes with risks that aren’t as prominent in public markets. There is a comparative lack of liquidity and transparency, more regulatory and operational considerations, and the requirement for expert due diligence. Therefore, having a trusted advisor to help decide if private markets are the right choice for you is important.

One way we can help is by addressing one of the key potential drawbacks of private markets - the liquidity constraints. Through portfolio simulations, we help investors understand the impact illiquidity can have on their annual spending requirements. This gives investors a clearer picture of how much they could allocate to private markets, without it having a negative effect on the amount of money they typically need access to.

If you are interested in learning more about our private markets offering, our digital private markets platform, or to find out whether investing in private markets is right for you, please contact us.

Important Information

Information correct as of 29 July 2024.

This document is designed as marketing material. This document has been composed by Brown Shipley & Co Ltd ("Brown Shipley”). Brown Shipley is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales No. 398426. Registered Office: 2 Moorgate, London, EC2R 6AG.

This document is for information purposes only, does not constitute individual (investment or tax) advice and investment decisions must not be based merely on this document. Whenever this document mentions a product, service or advice, it should be considered only as an indication or summary and cannot be seen as complete or fully accurate. All (investment or tax) decisions based on this information are for your own expense and for your own risk. You should (have) assess(ed) whether the product or service is suitable for your situation. Brown Shipley and its employees cannot be held liable for any loss or damage arising out of the use of (any part of) this document.

The contents of this document are based on publicly available information and/or sources which we deem trustworthy. Although reasonable care has been employed to publish data and information as truthfully and correctly as possible, we cannot accept any liability for the contents of this document, as far as it is based on those sources.

Investing involves risks and the value of investments may go up or down. Past performance is no indication of future performance. Currency fluctuations may influence your returns.

The information included is subject to change and Brown Shipley has no obligation after the date of publication of the text to update or amend the information accordingly. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it.

This is non-independent research and it has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

All copyrights and trademarks regarding this document are held by Brown Shipley, unless expressly stated otherwise. You are not allowed to copy, duplicate in any form or redistribute or use in any way the contents of this document, completely or partially, without the prior explicit and written approval of Brown Shipley. Notwithstanding anything herein to the contrary, and except as required to enable compliance with applicable securities law. See the privacy notice on our website for how your personal data is used (https://brownshipley.com/en-gb/privacy-and-cookie-policy).

© Brown Shipley 2024