Quite possibly, today’s fashion for private markets heralds one of the biggest changes in investing for many years. After the rise in correlations between stocks and bonds during recent stock market scares, private markets are increasingly recognised for their pivotal role in enhancing the effectiveness of modern portfolio asset allocation.

Think of the 2025 Trump tariff turmoil, 2022 inflation surge and 2020 Covid-19 sell-off. In all three market corrections, stocks and bonds fell together. By contrast, private markets investments, which aren’t typically traded daily, were stable.

It’s not just a matter of diversification, though. Private markets also offer access to investment opportunities that are not so readily available in public markets. Notably, they deliver more ways to gain exposure to contemporary investment mega trends such as decarbonisation, digitalisation and deglobalisation.

As investors seek both new forms of portfolio diversification and fresh investment opportunity, the private market investing universe is growing fast. Industry estimates project growth from USD 13 trillion today to more than USD 20 trillion by 2030.1 At Brown Shipley, we typically advise allocating 15% of portfolios to private assets.

UNDERSTANDING PRIVATE MARKETS

What are private markets? There are four broad types, taking in everything from the private equivalent of a stock to a straightforward investment in real estate. Unlike public stock markets, though, they’re illiquid, meaning they may theoretically generate higher returns than public markets due to the so-called illiquidity premium and they can’t be sold instantly for cash.

Private equity is the best established and biggest asset class. Since taking off in the 1980s buyout boom, it has provided capital for many well-known businesses, including some of the fast-growing US tech companies. Private equity funds acquire stakes in companies, to grow them and improve profits over periods of, typically, three to seven years.

It's complemented by private debt (or credit), which has grown rapidly in the past 15 years as regulations have forced banks to withdraw from some areas of lending. Private debt funds now provide about USD1.6 trillion in credit to companies.2 In return, the funds typically receive a relatively high rate of interest.

Infrastructure investing is the business of investing in the assets that support our daily lives – ranging from transport such as roads and airports, to renewable energy and the data centres increasingly needed to fuel artificial intelligence. Loans to the companies managing these assets pay relatively high returns and it’s the nature of many infrastructure businesses that they’re relatively unaffected by economic downturns.

Finally, real estate is one of the oldest asset classes. Real estate funds buy physical buildings of all types, aiming to profit from the rental yield and rise in capital value.

WHAT ARE THE BENEFITS OF PRIVATE MARKETS?

One of the two main benefits of private markets is the potential for higher long-term returns than public markets, due to the wider opportunity set- although these investments typically carry higher risk, are less liquid. Over long periods, they’ve tended to outperform public markets, due partly to the illiquidity premium. This is the extra return investors are paid for holding assets that are not easily converted into cash.

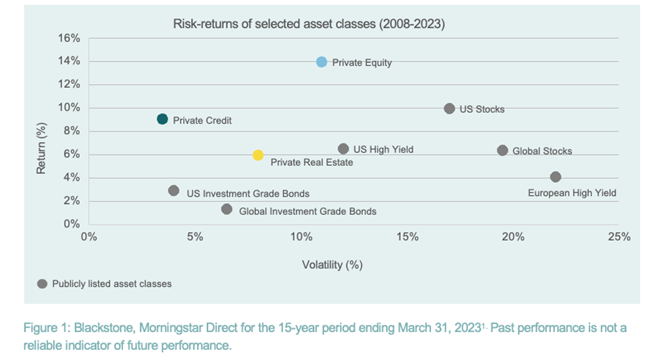

Private equity and private credit, respectively, have outperformed stocks and bonds over the 15 years from 2008 to 2023, while private real estate has performed in line with stocks (see chart below). Equally importantly, these private markets investments have generated strong risk-adjusted returns (again, see chart). This is judged by comparing the return of an investment against its price volatility. Of course, there can be no guarantees that higher returns will extend into the future.

Enhanced diversification is a second benefit. The rising correlation between stock and bond returns in recent years has reduced the effectiveness of each asset class as a hedge against the other during periods of high market volatility. By contrast, private market investments can be potentially an effective hedge against both asset classes, enhancing portfolio diversification.

Such portfolio diversification may lift the overall risk-adjusted returns of investment portfolios – something the Nobel Laureate Harry Markowitz famously referred to as “the only free lunch in investing”.

Strategic solutions for long-term growth and diversification

Private Markets Opportunities

THE CHALLENGES

As with all investments, though, private markets bring several challenges, which the right wealth manager can help with.

To start with, they’re less liquid than public markets, often requiring commitments of 3-10 years, depending on the type of private market investment. Similarly, private assets take years to mature. They’re hard to value, requiring in-depth financial analysis and valuation models that rely on assumptions about future performance. There are also regulatory and operational challenges. Finally, selecting the right managers and investment opportunities takes due diligence expertise.

ARE PRIVATE MARKETS RIGHT FOR YOU?

The characteristics of private market investments – including access to attractive investment opportunities, the potential for higher returns and lower correlation with public markets – make them an attractive option for investors. They have the potential to help build well-rounded and resilient portfolios.

Importantly, more and more of them are becoming available to individual investors, especially as specialist funds are launched for qualifying wealthy individuals.

However, it's important to understand the characteristics and risks of private markets in order to determine whether they are appropriate for your individual circumstances, objectives, and risk tolerance.

Get in touch with a Brown Shipley Client Advisor to learn more or download our ‘Your guide to Private Markets’.

Or get in touch with a Brown Shipley Client Advisor to learn more.

1 Preqin, September 2024, Carne Atlas, August 2024. Blackrock 2025 Private Markets Outlook. https://www.blackrock.com/ca/institutional/en/insights/private-markets-outlook

2 Preqin. September 2024.

Important Information

- Investing puts your capital at risk.

- This promotion is exclusively for professional clients and certified high-net-worth or sophisticated investors only.

- Investing in private markets involves significant risks, including illiquidity, capital loss, and valuation uncertainty.

- Past performance is not indicative of future results. These investments are not suitable for all investors.

Brown Shipley is a trading name of Brown Shipley & Co Limited, which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales No. 398426. Registered Office: 2 Moorgate, London, EC2R 6AG. Brown Shipley’s parent company is Quintet Private

Bank (Europe) S.A which, from Luxembourg, heads a major European network of private bankers. Copyright Brown Shipley.

Information correct as of June 2025.

© Brown Shipley 2025 reproduction strictly prohibited.