.png)

Daniele Antonucci

Co-Head of Investment & Chief Investment Officer

As we reach the midpoint of 2023, it's worth revisiting the predictions we made earlier in the year. Specifically, our three key macro calls that would take place around Q2: a peak in inflation (starting with the US), a pivot in central bank interest rate policy (starting with the US Federal Reserve, Fed), and a pick-up in China's growth. We refer to these as “the three Ps”.

The macro rationale behind these calls was based on the expectation of a recession in developed markets due to monetary tightening, which would curb inflation and lead central banks to pause rate increases. Meanwhile, a recovery would gain momentum in China, where there is no inflation problem but, rather, central bank stimulus and reopening.

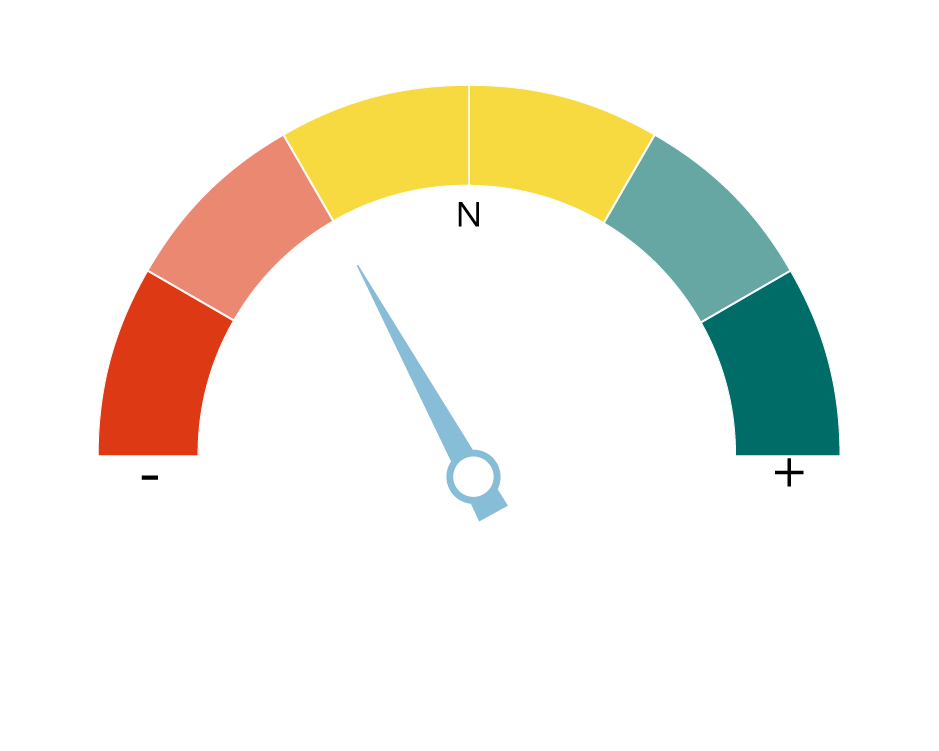

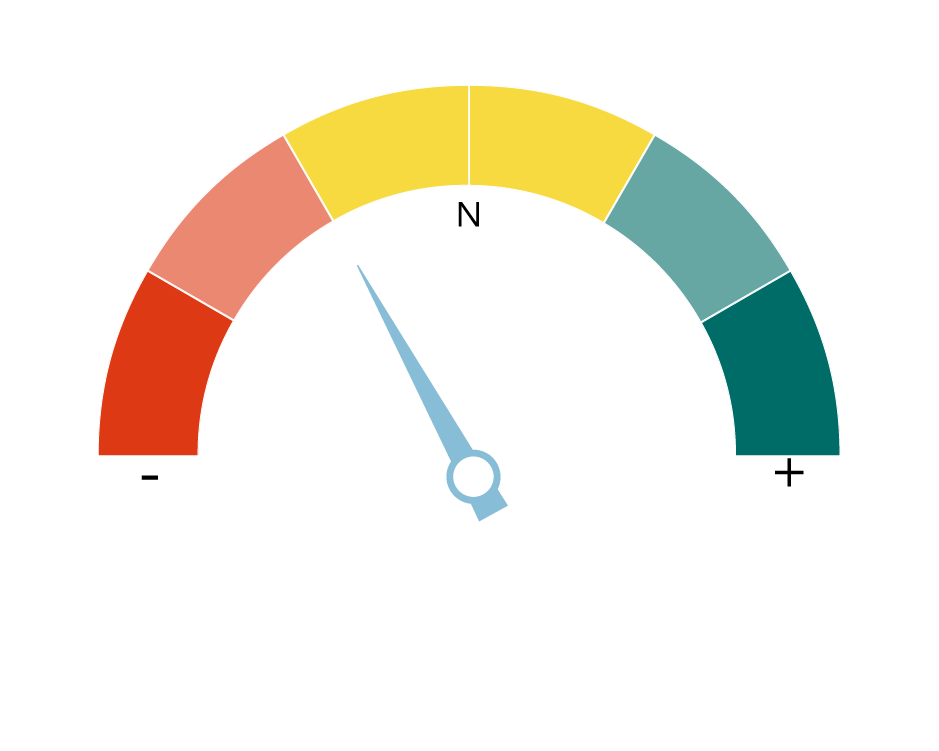

So, were our predictions right? Yes, partly. Inflation is showing clear signs of moving past the peak (in the US at least), leaving the door open for the Fed to pause its interest rate hiking cycle, and China’s growth has accelerated sooner - though perhaps less strongly - than expected and recent indicators point to slower progress. However, the prediction of a developed market recession has not yet come to fruition. Developed markets have proven to be more resilient than expected – the Eurozone and the UK in particular – thanks largely to energy disinflation and a mild winter, despite periods of weak growth. However, given the lagged impact of past interest rate hikes and the credit squeeze we envisage, a mild recession in the US now looks more likely in the second half of this year.

So, has our outlook changed as we look ahead to the rest of the year and beyond? Not a huge amount. We continue to believe we will see a divergence of growth and the emergence of new market cycles, driven by the so-called “three Ps”. We think the Eurozone and UK are probably where the US was six months ago, with inflation yet to peak convincingly and central banks looking to continue to raise rates – although not for long. Therefore, the balance of risks is skewed towards more European Central Bank and Bank of England hikes vs Fed.

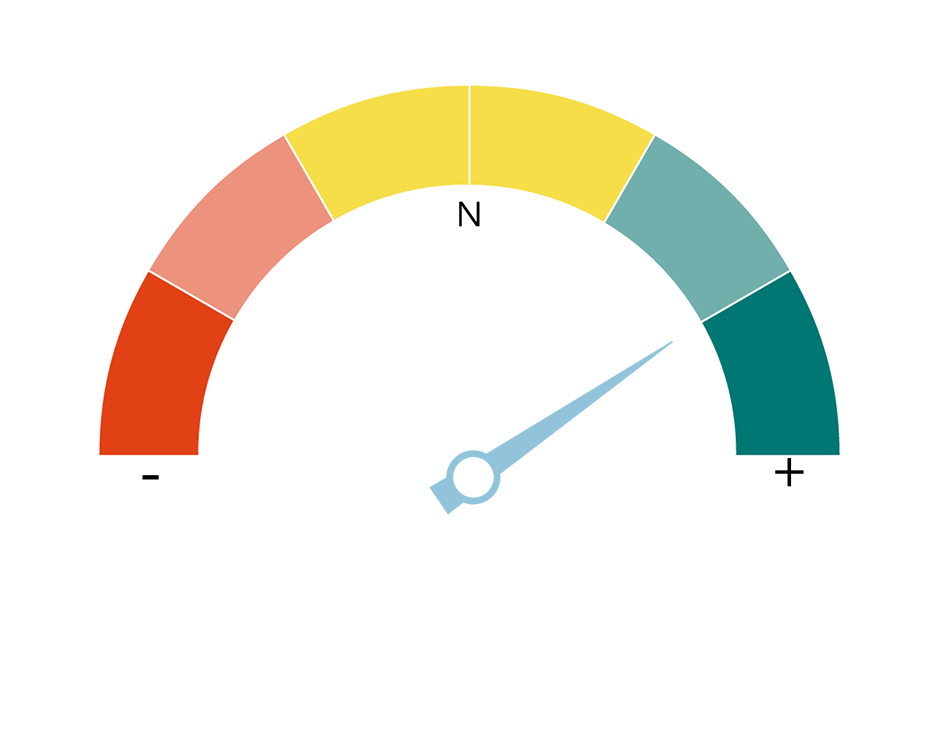

We also think the currency outlook is unlikely to shift significantly over the next couple of quarters. We believe the US dollar (USD) remains overvalued and the Fed pausing rates could lead to some USD weakness. As the Fed pauses, the real interest rate differential between the US and the Eurozone/UK should diminish. The euro and pound sterling should strengthen vs the USD, though moderately given weak domestic growth.

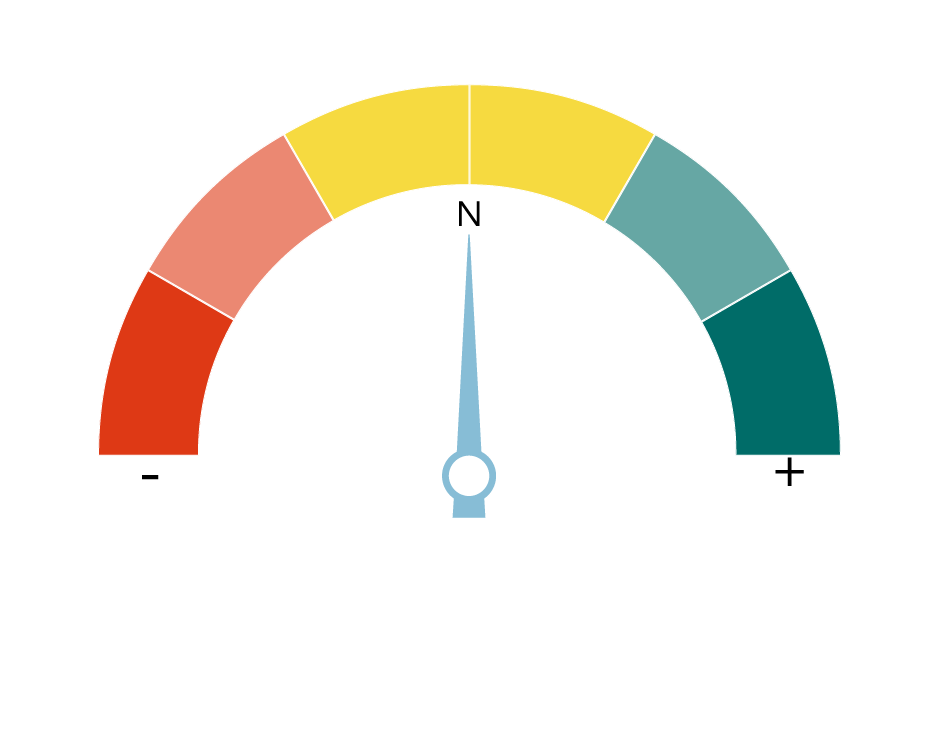

When it comes to the market landscape, our overall stance is also largely unchanged. Relative to our long-term asset allocation, we are allocating slightly more to high-quality bonds and slightly less to equities and credit, given market uncertainty and that we think the peak in interest rates is in sight. So, rather than an overhaul of our asset allocation, we’ll continue to make tweaks as trends and risks emerge.

Importantly, we have introduced a key long-term diversifier in our UK flagship portfolios - hedge funds - funded predominantly via reducing our gold allocation. Gold as an asset class provides attractive hedging properties by historically performing well in crisis periods. We decided to add hedge funds alongside gold as our historical analysis shows this would have led to improved risk-adjusted returns, lower volatility and less severe drawdowns. The goal is to achieve greater diversification. In this vein, we allocate to a blend of managers pursuing different investment strategies to reduce manager-specific risk.

.png?width=650&resizemode=force)

.png)